Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

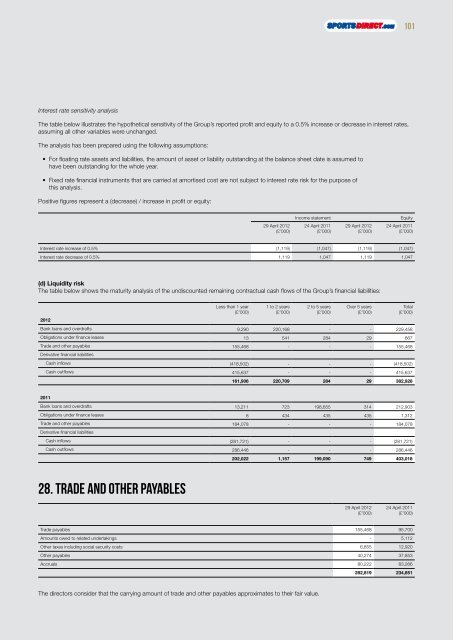

Interest rate sensitivity analysis<br />

The table below illustrates the hypothetical sensitivity of the Group’s reported profit and equity to a 0.5% increase or decrease in interest rates,<br />

assuming all other variables were unchanged.<br />

The analysis has been prepared using the following assumptions:<br />

• For floating rate assets and liabilities, the amount of asset or liability outstanding at the balance sheet date is assumed to<br />

have been outstanding for the whole year.<br />

• Fixed rate financial instruments that are carried at amortised cost are not subject to interest rate risk for the purpose of<br />

this analysis.<br />

Positive figures represent a (decrease) / increase in profit or equity:<br />

29 April <strong>2012</strong><br />

(£’000)<br />

Income statement Equity<br />

24 April 2011<br />

(£’000)<br />

29 April <strong>2012</strong><br />

(£’000)<br />

24 April 2011<br />

(£’000)<br />

Interest rate increase of 0.5% (1,1<strong>19</strong>) (1,047) (1,1<strong>19</strong>) (1,047)<br />

Interest rate decrease of 0.5% 1,1<strong>19</strong> 1,047 1,1<strong>19</strong> 1,047<br />

(d) Liquidity risk<br />

The table below shows the maturity analysis of the undiscounted remaining contractual cash flows of the Group’s financial liabilities:<br />

Less than 1 year<br />

(£’000)<br />

1 to 2 years<br />

(£’000)<br />

2 to 5 years<br />

(£’000)<br />

Over 5 years<br />

(£’000)<br />

<strong>2012</strong><br />

Bank loans and overdrafts 9,290 220,168 - - 229,458<br />

Obligations under finance leases 13 541 284 29 867<br />

Trade and other payables<br />

Derivative financial liabilities<br />

155,468 - - - 155,468<br />

Cash inflows (418,502) - - - (418,502)<br />

Cash outflows 415,637 - - - 415,637<br />

161,906 220,709 284 29 382,928<br />

2011<br />

Bank loans and overdrafts 13,211 723 <strong>19</strong>8,655 314 212,903<br />

Obligations under finance leases 8 434 435 435 1,312<br />

Trade and other payables<br />

Derivative financial liabilities<br />

184,078 - - - 184,078<br />

Cash inflows (281,721) - - - (281,721)<br />

Cash outflows 286,446 - - - 286,446<br />

202,022 1,157 <strong>19</strong>9,090 749 403,018<br />

28. Trade and other payables<br />

29 April <strong>2012</strong><br />

(£’000)<br />

Total<br />

(£’000)<br />

24 April 2011<br />

(£’000)<br />

Trade payables 155,468 95,700<br />

Amounts owed to related undertakings - 5,112<br />

Other taxes including social security costs 6,855 12,920<br />

Other payables 40,274 37,853<br />

Accruals 80,222 83,266<br />

282,8<strong>19</strong> 234,851<br />

The directors consider that the carrying amount of trade and other payables approximates to their fair value.<br />

101

![Our ref: [ ] - Sports Direct International](https://img.yumpu.com/19248141/1/184x260/our-ref-sports-direct-international.jpg?quality=85)

![Our ref: [ ] - Sports Direct International](https://img.yumpu.com/18440214/1/184x260/our-ref-sports-direct-international.jpg?quality=85)