Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

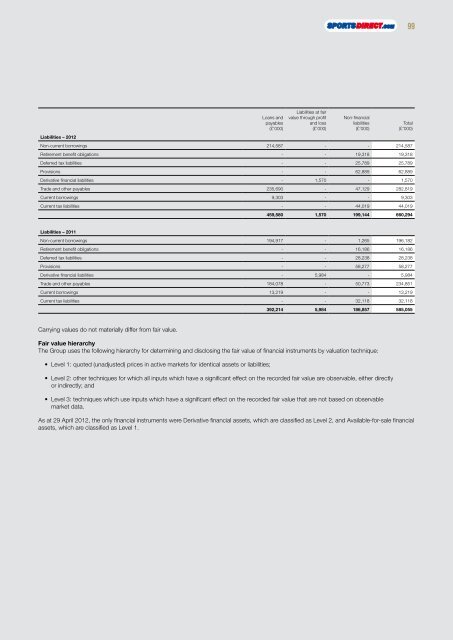

Loans and<br />

payables<br />

(£’000)<br />

Liabilities at fair<br />

value through profit<br />

and loss<br />

(£’000)<br />

Non-financial<br />

liabilities<br />

(£’000)<br />

Liabilities – <strong>2012</strong><br />

Non-current borrowings 214,587 - - 214,587<br />

Retirement benefit obligations - - <strong>19</strong>,318 <strong>19</strong>,318<br />

Deferred tax liabilities - - 25,789 25,789<br />

Provisions - - 62,889 62,889<br />

Derivative financial liabilities - 1,570 - 1,570<br />

Trade and other payables 235,690 - 47,129 282,8<strong>19</strong><br />

Current borrowings 9,303 - - 9,303<br />

Current tax liabilities - - 44,0<strong>19</strong> 44,0<strong>19</strong><br />

459,580 1,570 <strong>19</strong>9,144 660,294<br />

Liabilities – 2011<br />

Non-current borrowings <strong>19</strong>4,917 - 1,265 <strong>19</strong>6,182<br />

Retirement benefit obligations - - 16,186 16,186<br />

Deferred tax liabilities - - 28,238 28,238<br />

Provisions - - 58,277 58,277<br />

Derivative financial liabilities - 5,984 - 5,984<br />

Trade and other payables 184,078 - 50,773 234,851<br />

Current borrowings 13,2<strong>19</strong> - - 13,2<strong>19</strong><br />

Current tax liabilities - - 32,118 32,118<br />

392,214 5,984 186,857 585,055<br />

Carrying values do not materially differ from fair value.<br />

Fair value hierarchy<br />

The Group uses the following hierarchy for determining and disclosing the fair value of financial instruments by valuation technique:<br />

• Level 1: quoted (unadjusted) prices in active markets for identical assets or liabilities;<br />

• Level 2: other techniques for which all inputs which have a significant effect on the recorded fair value are observable, either directly<br />

or indirectly; and<br />

• Level 3: techniques which use inputs which have a significant effect on the recorded fair value that are not based on observable<br />

market data.<br />

As at 29 April <strong>2012</strong>, the only financial instruments were Derivative financial assets, which are classified as Level 2, and Available-for-sale financial<br />

assets, which are classified as Level 1.<br />

99<br />

Total<br />

(£’000)

![Our ref: [ ] - Sports Direct International](https://img.yumpu.com/19248141/1/184x260/our-ref-sports-direct-international.jpg?quality=85)

![Our ref: [ ] - Sports Direct International](https://img.yumpu.com/18440214/1/184x260/our-ref-sports-direct-international.jpg?quality=85)