Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

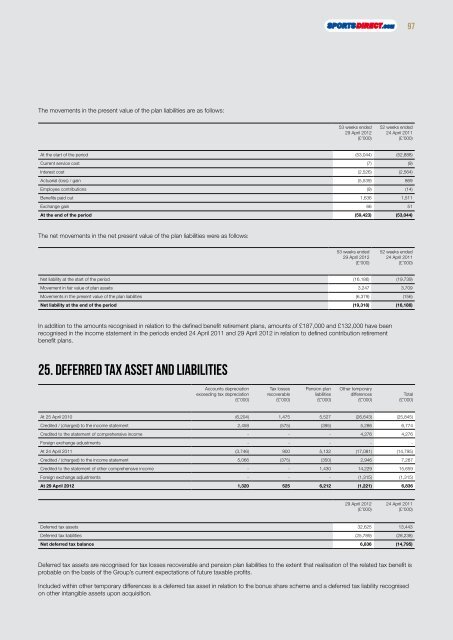

The movements in the present value of the plan liabilities are as follows:<br />

53 weeks ended<br />

29 April <strong>2012</strong><br />

(£’000)<br />

52 weeks ended<br />

24 April 2011<br />

(£’000)<br />

At the start of the period (53,044) (52,888)<br />

Current service cost (7) (9)<br />

Interest cost (2,526) (2,564)<br />

Actuarial (loss) / gain (5,539) 869<br />

Employee contributions (9) (14)<br />

Benefits paid out 1,636 1,511<br />

Exchange gain 66 51<br />

At the end of the period (59,423) (53,044)<br />

The net movements in the net present value of the plan liabilities were as follows:<br />

53 weeks ended<br />

29 April <strong>2012</strong><br />

(£’000)<br />

52 weeks ended<br />

24 April 2011<br />

(£’000)<br />

Net liability at the start of the period (16,186) (<strong>19</strong>,739)<br />

Movement in fair value of plan assets 3,247 3,709<br />

Movements in the present value of the plan liabilities (6,379) (156)<br />

Net liability at the end of the period (<strong>19</strong>,318) (16,186)<br />

In addition to the amounts recognised in relation to the defined benefit retirement plans, amounts of £187,000 and £132,000 have been<br />

recognised in the income statement in the periods ended 24 April 2011 and 29 April <strong>2012</strong> in relation to defined contribution retirement<br />

benefit plans.<br />

25. Deferred tax asset and liabilities<br />

Accounts depreciation<br />

exceeding tax depreciation<br />

(£’000)<br />

Tax losses<br />

recoverable<br />

(£’000)<br />

Pension plan<br />

liabilities<br />

(£’000)<br />

Other temporary<br />

differences<br />

(£’000)<br />

At 25 April 2010 (6,204) 1,475 5,527 (26,643) (25,845)<br />

Credited / (charged) to the income statement 2,458 (575) (395) 5,286 6,774<br />

Credited to the statement of comprehensive income - - - 4,276 4,276<br />

Foreign exchange adjustments - - - - -<br />

At 24 April 2011 (3,746) 900 5,132 (17,081) (14,795)<br />

Credited / (charged) to the income statement 5,066 (375) (350) 2,946 7,287<br />

Credited to the statement of other comprehensive income - - 1,430 14,229 15,659<br />

Foreign exchange adjustments - - - (1,315) (1,315)<br />

At 29 April <strong>2012</strong> 1,320 525 6,212 (1,221) 6,836<br />

29 April <strong>2012</strong><br />

(£’000)<br />

Total<br />

(£’000)<br />

24 April 2011<br />

(£’000)<br />

Deferred tax assets 32,625 13,443<br />

Deferred tax liabilities (25,789) (28,238)<br />

Net deferred tax balance 6,836 (14,795)<br />

Deferred tax assets are recognised for tax losses recoverable and pension plan liabilities to the extent that realisation of the related tax benefit is<br />

probable on the basis of the Group’s current expectations of future taxable profits.<br />

Included within other temporary differences is a deferred tax asset in relation to the bonus share scheme and a deferred tax liability recognised<br />

on other intangible assets upon acquisition.<br />

97

![Our ref: [ ] - Sports Direct International](https://img.yumpu.com/19248141/1/184x260/our-ref-sports-direct-international.jpg?quality=85)

![Our ref: [ ] - Sports Direct International](https://img.yumpu.com/18440214/1/184x260/our-ref-sports-direct-international.jpg?quality=85)