Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

84 / FINANCIAL STATEMENTS AND NOTES<br />

notes to the Financial Statements<br />

For the 53 weeks ended 29 April <strong>2012</strong><br />

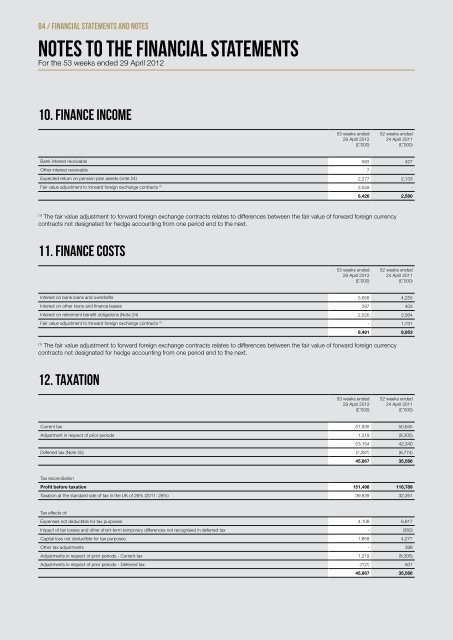

10. Finance income<br />

53 weeks ended<br />

29 April <strong>2012</strong><br />

(£’000)<br />

52 weeks ended<br />

24 April 2011<br />

(£’000)<br />

Bank interest receivable 583 427<br />

Other interest receivable 7 -<br />

Expected return on pension plan assets (note 24) 2,277 2,133<br />

Fair value adjustment to forward foreign exchange contracts (1)<br />

3,559 -<br />

6,426 2,560<br />

(1) The fair value adjustment to forward foreign exchange contracts relates to differences between the fair value of forward foreign currency<br />

contracts not designated for hedge accounting from one period end to the next.<br />

11. Finance costs<br />

53 weeks ended<br />

29 April <strong>2012</strong><br />

(£’000)<br />

52 weeks ended<br />

24 April 2011<br />

(£’000)<br />

Interest on bank loans and overdrafts 5,658 4,255<br />

Interest on other loans and finance leases 297 403<br />

Interest on retirement benefit obligations (Note 24) 2,526 2,564<br />

Fair value adjustment to forward foreign exchange contracts (1)<br />

- 1,731<br />

8,481 8,953<br />

(1) The fair value adjustment to forward foreign exchange contracts relates to differences between the fair value of forward foreign currency<br />

contracts not designated for hedge accounting from one period end to the next.<br />

12. Taxation<br />

53 weeks ended<br />

29 April <strong>2012</strong><br />

(£’000)<br />

52 weeks ended<br />

24 April 2011<br />

(£’000)<br />

Current tax 51,935 50,645<br />

Adjustment in respect of prior periods 1,2<strong>19</strong> (8,305)<br />

53,154 42,340<br />

Deferred tax (Note 25) (7,287) (6,774)<br />

45,867 35,566<br />

Tax reconciliation<br />

Profit before taxation 151,498 118,789<br />

Taxation at the standard rate of tax in the UK of 26% (2011: 28%) 39,839 32,261<br />

Tax effects of:<br />

Expenses not deductible for tax purposes 4,108 6,817<br />

Impact of tax losses and other short-term temporary differences not recognised in deferred tax - (383)<br />

Capital loss not deductible for tax purposes 1,858 4,277<br />

Other tax adjustments - 398<br />

Adjustments in respect of prior periods - Current tax 1,2<strong>19</strong> (8,305)<br />

Adjustments in respect of prior periods - Deferred tax (707) 501<br />

45,867 35,566

![Our ref: [ ] - Sports Direct International](https://img.yumpu.com/19248141/1/184x260/our-ref-sports-direct-international.jpg?quality=85)

![Our ref: [ ] - Sports Direct International](https://img.yumpu.com/18440214/1/184x260/our-ref-sports-direct-international.jpg?quality=85)