Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

94 / FINANCIAL STATEMENTS AND NOTES<br />

notes to the Financial Statements<br />

For the 53 weeks ended 29 April <strong>2012</strong><br />

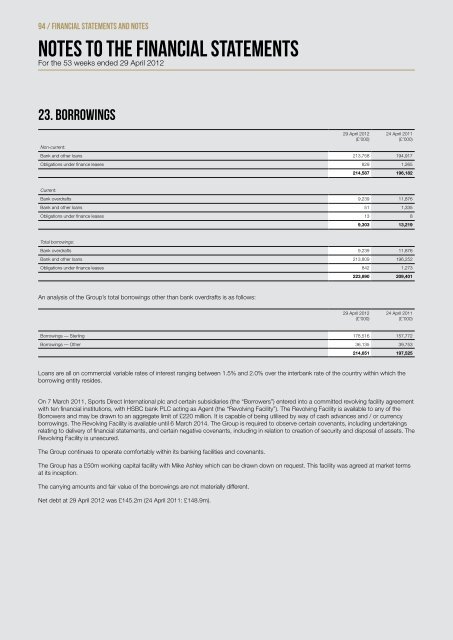

23. Borrowings<br />

Non-current:<br />

29 April <strong>2012</strong><br />

(£’000)<br />

24 April 2011<br />

(£’000)<br />

Bank and other loans 213,758 <strong>19</strong>4,917<br />

Obligations under finance leases 829 1,265<br />

Current:<br />

214,587 <strong>19</strong>6,182<br />

Bank overdrafts 9,239 11,876<br />

Bank and other loans 51 1,335<br />

Obligations under finance leases 13 8<br />

Total borrowings:<br />

9,303 13,2<strong>19</strong><br />

Bank overdrafts 9,239 11,876<br />

Bank and other loans 213,809 <strong>19</strong>6,252<br />

Obligations under finance leases 842 1,273<br />

An analysis of the Group’s total borrowings other than bank overdrafts is as follows:<br />

223,890 209,401<br />

29 April <strong>2012</strong><br />

(£’000)<br />

24 April 2011<br />

(£’000)<br />

Borrowings — Sterling 178,516 157,772<br />

Borrowings — Other 36,135 39,753<br />

214,651 <strong>19</strong>7,525<br />

Loans are all on commercial variable rates of interest ranging between 1.5% and 2.0% over the interbank rate of the country within which the<br />

borrowing entity resides.<br />

On 7 March 2011, <strong>Sports</strong> <strong>Direct</strong> <strong>International</strong> plc and certain subsidiaries (the “Borrowers”) entered into a committed revolving facility agreement<br />

with ten financial institutions, with HSBC bank PLC acting as Agent (the “Revolving Facility”). The Revolving Facility is available to any of the<br />

Borrowers and may be drawn to an aggregate limit of £220 million. It is capable of being utilised by way of cash advances and / or currency<br />

borrowings. The Revolving Facility is available until 6 March 2014. The Group is required to observe certain covenants, including undertakings<br />

relating to delivery of financial statements, and certain negative covenants, including in relation to creation of security and disposal of assets. The<br />

Revolving Facility is unsecured.<br />

The Group continues to operate comfortably within its banking facilities and covenants.<br />

The Group has a £50m working capital facility with Mike Ashley which can be drawn down on request. This facility was agreed at market terms<br />

at its inception.<br />

The carrying amounts and fair value of the borrowings are not materially different.<br />

Net debt at 29 April <strong>2012</strong> was £145.2m (24 April 2011: £148.9m).

![Our ref: [ ] - Sports Direct International](https://img.yumpu.com/19248141/1/184x260/our-ref-sports-direct-international.jpg?quality=85)

![Our ref: [ ] - Sports Direct International](https://img.yumpu.com/18440214/1/184x260/our-ref-sports-direct-international.jpg?quality=85)