Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

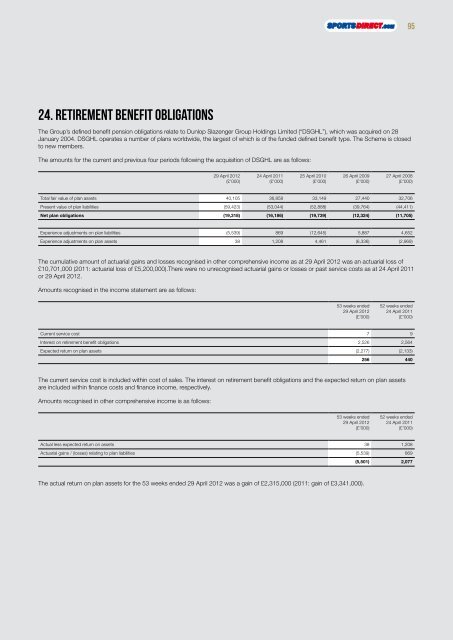

24. Retirement benefit obligations<br />

The Group’s defined benefit pension obligations relate to Dunlop Slazenger Group Holdings Limited (“DSGHL”), which was acquired on 28<br />

January 2004. DSGHL operates a number of plans worldwide, the largest of which is of the funded defined benefit type. The Scheme is closed<br />

to new members.<br />

The amounts for the current and previous four periods following the acquisition of DSGHL are as follows:<br />

29 April <strong>2012</strong><br />

(£’000)<br />

24 April 2011<br />

(£’000)<br />

25 April 2010<br />

(£’000)<br />

26 April 2009<br />

(£’000)<br />

27 April 2008<br />

(£’000)<br />

Total fair value of plan assets 40,105 36,858 33,149 27,440 32,706<br />

Present value of plan liabilities (59,423) (53,044) (52,888) (39,764) (44,411)<br />

Net plan obligations (<strong>19</strong>,318) (16,186) (<strong>19</strong>,739) (12,324) (11,705)<br />

Experience adjustments on plan liabilities (5,539) 869 (12,645) 5,887 4,652<br />

Experience adjustments on plan assets 38 1,208 4,461 (6,336) (2,969)<br />

The cumulative amount of actuarial gains and losses recognised in other comprehensive income as at 29 April <strong>2012</strong> was an actuarial loss of<br />

£10,701,000 (2011: actuarial loss of £5,200,000).There were no unrecognised actuarial gains or losses or past service costs as at 24 April 2011<br />

or 29 April <strong>2012</strong>.<br />

Amounts recognised in the income statement are as follows:<br />

53 weeks ended<br />

29 April <strong>2012</strong><br />

(£’000)<br />

52 weeks ended<br />

24 April 2011<br />

(£’000)<br />

Current service cost 7 9<br />

Interest on retirement benefit obligations 2,526 2,564<br />

Expected return on plan assets (2,277) (2,133)<br />

256 440<br />

The current service cost is included within cost of sales. The interest on retirement benefit obligations and the expected return on plan assets<br />

are included within finance costs and finance income, respectively.<br />

Amounts recognised in other comprehensive income is as follows:<br />

53 weeks ended<br />

29 April <strong>2012</strong><br />

(£’000)<br />

52 weeks ended<br />

24 April 2011<br />

(£’000)<br />

Actual less expected return on assets 38 1,208<br />

Actuarial gains / (losses) relating to plan liabilities (5,539) 869<br />

(5,501) 2,077<br />

The actual return on plan assets for the 53 weeks ended 29 April <strong>2012</strong> was a gain of £2,315,000 (2011: gain of £3,341,000).<br />

95

![Our ref: [ ] - Sports Direct International](https://img.yumpu.com/19248141/1/184x260/our-ref-sports-direct-international.jpg?quality=85)

![Our ref: [ ] - Sports Direct International](https://img.yumpu.com/18440214/1/184x260/our-ref-sports-direct-international.jpg?quality=85)