Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

96 / FINANCIAL STATEMENTS AND NOTES<br />

notes to the Financial Statements<br />

For the 53 weeks ended 29 April <strong>2012</strong><br />

24. Retirement benefit obligations Continued<br />

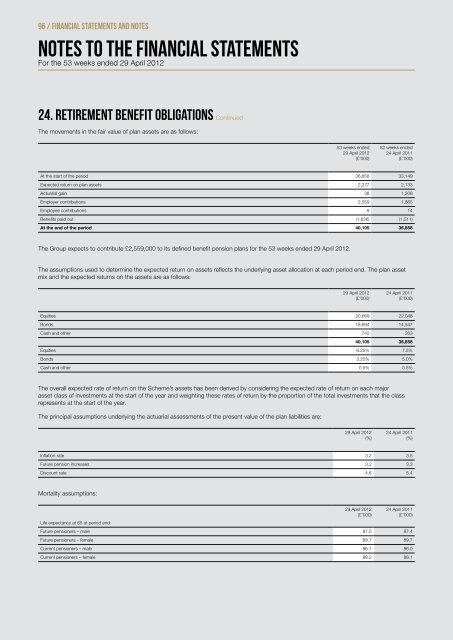

The movements in the fair value of plan assets are as follows:<br />

53 weeks ended<br />

29 April <strong>2012</strong><br />

(£’000)<br />

52 weeks ended<br />

24 April 2011<br />

(£’000)<br />

At the start of the period 36,858 33,149<br />

Expected return on plan assets 2,277 2,133<br />

Actuarial gain 38 1,208<br />

Employer contributions 2,559 1,865<br />

Employee contributions 9 14<br />

Benefits paid out (1,636) (1,511)<br />

At the end of the period 40,105 36,858<br />

The Group expects to contribute £2,559,000 to its defined benefit pension plans for the 53 weeks ended 29 April <strong>2012</strong>.<br />

The assumptions used to determine the expected return on assets reflects the underlying asset allocation at each period end. The plan asset<br />

mix and the expected returns on the assets are as follows:<br />

29 April <strong>2012</strong><br />

(£’000)<br />

24 April 2011<br />

(£’000)<br />

Equities 20,669 22,048<br />

Bonds 18,694 14,547<br />

Cash and other 742 263<br />

40,105 36,858<br />

Equities 6.25% 7.5%<br />

Bonds 3.25% 5.0%<br />

Cash and other 0.5% 0.5%<br />

The overall expected rate of return on the Scheme’s assets has been derived by considering the expected rate of return on each major<br />

asset class of investments at the start of the year and weighting these rates of return by the proportion of the total investments that the class<br />

represents at the start of the year.<br />

The principal assumptions underlying the actuarial assessments of the present value of the plan liabilities are:<br />

29 April <strong>2012</strong><br />

(%)<br />

24 April 2011<br />

(%)<br />

Inflation rate 3.2 3.5<br />

Future pension increases 3.2 3.3<br />

Discount rate 4.6 5.4<br />

Mortality assumptions:<br />

29 April <strong>2012</strong><br />

(£’000)<br />

24 April 2011<br />

(£’000)<br />

Life expectancy at 65 at period end:<br />

Future pensioners – male 87.5 87.4<br />

Future pensioners – female 89.7 89.7<br />

Current pensioners – male 86.1 86.0<br />

Current pensioners – female 88.2 88.1

![Our ref: [ ] - Sports Direct International](https://img.yumpu.com/19248141/1/184x260/our-ref-sports-direct-international.jpg?quality=85)

![Our ref: [ ] - Sports Direct International](https://img.yumpu.com/18440214/1/184x260/our-ref-sports-direct-international.jpg?quality=85)