Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

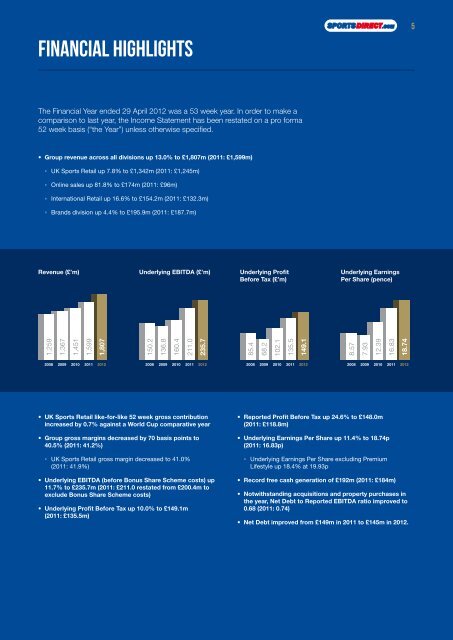

financial highlights<br />

The Financial Year ended 29 April <strong>2012</strong> was a 53 week year. In order to make a<br />

comparison to last year, the Income Statement has been restated on a pro forma<br />

52 week basis (“the Year”) unless otherwise specified.<br />

• Group revenue across all divisions up 13.0% to £1,807m (2011: £1,599m)<br />

◦ UK <strong>Sports</strong> Retail up 7.8% to £1,342m (2011: £1,245m)<br />

◦ Online sales up 81.8% to £174m (2011: £96m)<br />

◦ <strong>International</strong> Retail up 16.6% to £154.2m (2011: £132.3m)<br />

◦ Brands division up 4.4% to £<strong>19</strong>5.9m (2011: £187.7m)<br />

Revenue (£’m)<br />

1,259<br />

2008<br />

1,367<br />

2009<br />

1,451<br />

2010<br />

1,599<br />

2011<br />

1,807<br />

<strong>2012</strong><br />

Underlying EBITDA (£’m)<br />

150.2<br />

2008<br />

136.8<br />

2009<br />

160.4<br />

2010<br />

211.0<br />

2011<br />

235.7<br />

• UK <strong>Sports</strong> Retail like-for-like 52 week gross contribution<br />

increased by 0.7% against a World Cup comparative year<br />

• Group gross margins decreased by 70 basis points to<br />

40.5% (2011: 41.2%)<br />

◦ UK <strong>Sports</strong> Retail gross margin decreased to 41.0%<br />

(2011: 41.9%)<br />

• Underlying EBITDA (before Bonus Share Scheme costs) up<br />

11.7% to £235.7m (2011: £211.0 restated from £200.4m to<br />

exclude Bonus Share Scheme costs)<br />

• Underlying Profit Before Tax up 10.0% to £149.1m<br />

(2011: £135.5m)<br />

<strong>2012</strong><br />

Underlying Profit<br />

Before Tax (£’m)<br />

85.4<br />

2008<br />

68.2<br />

2009<br />

102.1<br />

2010<br />

135.5<br />

2011<br />

149.1<br />

<strong>2012</strong><br />

Underlying Earnings<br />

Per Share (pence)<br />

8.57<br />

2008<br />

7.93<br />

2009<br />

12.39<br />

2010<br />

• Reported Profit Before Tax up 24.6% to £148.0m<br />

(2011: £118.8m)<br />

• Underlying Earnings Per Share up 11.4% to 18.74p<br />

(2011: 16.83p)<br />

◦ Underlying Earnings Per Share excluding Premium<br />

Lifestyle up 18.4% at <strong>19</strong>.93p<br />

16.83<br />

2011<br />

• Record free cash generation of £<strong>19</strong>2m (2011: £184m)<br />

18.74<br />

• Notwithstanding acquisitions and property purchases in<br />

the year, Net Debt to Reported EBITDA ratio improved to<br />

0.68 (2011: 0.74)<br />

• Net Debt improved from £149m in 2011 to £145m in <strong>2012</strong>.<br />

<strong>2012</strong><br />

5

![Our ref: [ ] - Sports Direct International](https://img.yumpu.com/19248141/1/184x260/our-ref-sports-direct-international.jpg?quality=85)

![Our ref: [ ] - Sports Direct International](https://img.yumpu.com/18440214/1/184x260/our-ref-sports-direct-international.jpg?quality=85)