2003 / 2004 - Bellevue College

2003 / 2004 - Bellevue College

2003 / 2004 - Bellevue College

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

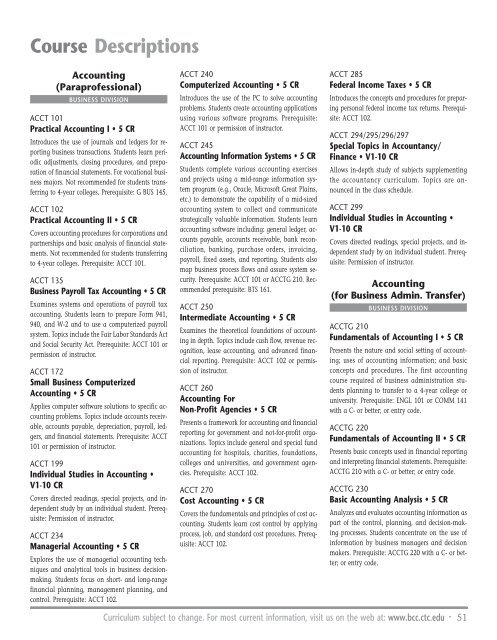

Course Descriptions<br />

Accounting<br />

(Paraprofessional)<br />

BUSINESS DIVISION<br />

ACCT 101<br />

Practical Accounting I • 5 CR<br />

Introduces the use of journals and ledgers for reporting<br />

business transactions. Students learn periodic<br />

adjustments, closing procedures, and preparation<br />

of financial statements. For vocational business<br />

majors. Not recommended for students transferring<br />

to 4-year colleges. Prerequisite: G BUS 145.<br />

ACCT 102<br />

Practical Accounting II • 5 CR<br />

Covers accounting procedures for corporations and<br />

partnerships and basic analysis of financial statements.<br />

Not recommended for students transferring<br />

to 4-year colleges. Prerequisite: ACCT 101.<br />

ACCT 135<br />

Business Payroll Tax Accounting • 5 CR<br />

Examines systems and operations of payroll tax<br />

accounting. Students learn to prepare Form 941,<br />

940, and W-2 and to use a computerized payroll<br />

system. Topics include the Fair Labor Standards Act<br />

and Social Security Act. Prerequisite: ACCT 101 or<br />

permission of instructor.<br />

ACCT 172<br />

Small Business Computerized<br />

Accounting • 5 CR<br />

Applies computer software solutions to specific accounting<br />

problems. Topics include accounts receivable,<br />

accounts payable, depreciation, payroll, ledgers,<br />

and financial statements. Prerequisite: ACCT<br />

101 or permission of instructor.<br />

ACCT 199<br />

Individual Studies in Accounting •<br />

V1-10 CR<br />

Covers directed readings, special projects, and independent<br />

study by an individual student. Prerequisite:<br />

Permission of instructor.<br />

ACCT 234<br />

Managerial Accounting • 5 CR<br />

Explores the use of managerial accounting techniques<br />

and analytical tools in business decisionmaking.<br />

Students focus on short- and long-range<br />

financial planning, management planning, and<br />

control. Prerequisite: ACCT 102.<br />

ACCT 240<br />

Computerized Accounting • 5 CR<br />

Introduces the use of the PC to solve accounting<br />

problems. Students create accounting applications<br />

using various software programs. Prerequisite:<br />

ACCT 101 or permission of instructor.<br />

ACCT 245<br />

Accounting Information Systems • 5 CR<br />

Students complete various accounting exercises<br />

and projects using a mid-range information system<br />

program (e.g., Oracle, Microsoft Great Plains,<br />

etc.) to demonstrate the capability of a mid-sized<br />

accounting system to collect and communicate<br />

strategically valuable information. Students learn<br />

accounting software including: general ledger, accounts<br />

payable, accounts receivable, bank reconciliation,<br />

banking, purchase orders, invoicing,<br />

payroll, fixed assets, and reporting. Students also<br />

map business process flows and assure system security.<br />

Prerequisite: ACCT 101 or ACCTG 210. Recommended<br />

prerequisite: BTS 161.<br />

ACCT 250<br />

Intermediate Accounting • 5 CR<br />

Examines the theoretical foundations of accounting<br />

in depth. Topics include cash flow, revenue recognition,<br />

lease accounting, and advanced financial<br />

reporting. Prerequisite: ACCT 102 or permission<br />

of instructor.<br />

ACCT 260<br />

Accounting For<br />

Non-Profit Agencies • 5 CR<br />

Presents a framework for accounting and financial<br />

reporting for government and not-for-profit organizations.<br />

Topics include general and special fund<br />

accounting for hospitals, charities, foundations,<br />

colleges and universities, and government agencies.<br />

Prerequisite: ACCT 102.<br />

ACCT 270<br />

Cost Accounting • 5 CR<br />

Covers the fundamentals and principles of cost accounting.<br />

Students learn cost control by applying<br />

process, job, and standard cost procedures. Prerequisite:<br />

ACCT 102.<br />

ACCT 285<br />

Federal Income Taxes • 5 CR<br />

Introduces the concepts and procedures for preparing<br />

personal federal income tax returns. Prerequisite:<br />

ACCT 102.<br />

ACCT 294/295/296/297<br />

Special Topics in Accountancy/<br />

Finance • V1-10 CR<br />

Allows in-depth study of subjects supplementing<br />

the accountancy curriculum. Topics are announced<br />

in the class schedule.<br />

ACCT 299<br />

Individual Studies in Accounting •<br />

V1-10 CR<br />

Covers directed readings, special projects, and independent<br />

study by an individual student. Prerequisite:<br />

Permission of instructor.<br />

Accounting<br />

(for Business Admin. Transfer)<br />

BUSINESS DIVISION<br />

ACCTG 210<br />

Fundamentals of Accounting I • 5 CR<br />

Presents the nature and social setting of accounting;<br />

uses of accounting information; and basic<br />

concepts and procedures. The first accounting<br />

course required of business administration students<br />

planning to transfer to a 4-year college or<br />

university. Prerequisite: ENGL 101 or COMM 141<br />

with a C- or better; or entry code.<br />

ACCTG 220<br />

Fundamentals of Accounting II • 5 CR<br />

Presents basic concepts used in financial reporting<br />

and interpreting financial statements. Prerequisite:<br />

ACCTG 210 with a C- or better; or entry code.<br />

ACCTG 230<br />

Basic Accounting Analysis • 5 CR<br />

Analyzes and evaluates accounting information as<br />

part of the control, planning, and decision-making<br />

processes. Students concentrate on the use of<br />

information by business managers and decision<br />

makers. Prerequisite: ACCTG 220 with a C- or better;<br />

or entry code.<br />

Curriculum subject to change. For most current information, visit us on the web at: www.bcc.ctc.edu • 51