Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The statutory residence test<br />

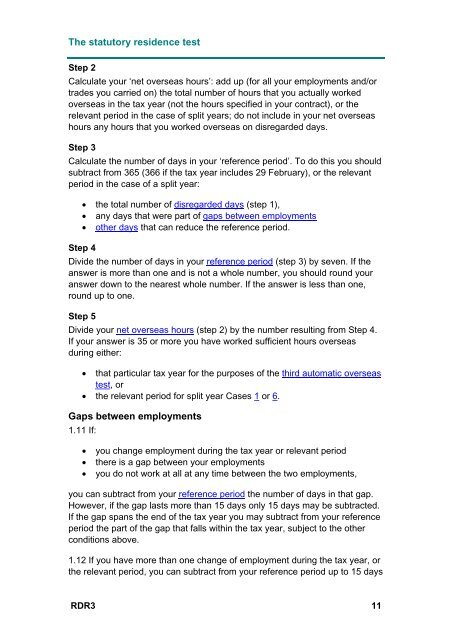

Step 2<br />

Calculate your ‘net overseas hours’: add up (for all your employments and/or<br />

trades you carried on) the total number of hours that you actually worked<br />

overseas in the tax year (not the hours specified in your contract), or the<br />

relevant period in the case of split years; do not include in your net overseas<br />

hours any hours that you worked overseas on disregarded days.<br />

Step 3<br />

Calculate the number of days in your ‘reference period’. To do this you should<br />

subtract from 365 (366 if the tax year includes 29 February), or the relevant<br />

period in the case of a split year:<br />

the total number of disregarded days (step 1),<br />

any days that were part of gaps between employments<br />

other days that can reduce the reference period.<br />

Step 4<br />

Divide the number of days in your reference period (step 3) by seven. If the<br />

answer is more than one and is not a whole number, you should round your<br />

answer down to the nearest whole number. If the answer is less than one,<br />

round up to one.<br />

Step 5<br />

Divide your net overseas hours (step 2) by the number resulting from Step 4.<br />

If your answer is 35 or more you have worked sufficient hours overseas<br />

during either:<br />

that particular tax year for the purposes of the third automatic overseas<br />

test, or<br />

the relevant period for split year Cases 1 or 6.<br />

Gaps between employments<br />

1.11 If:<br />

<br />

<br />

<br />

you change employment during the tax year or relevant period<br />

there is a gap between your employments<br />

you do not work at all at any time between the two employments,<br />

you can subtract from your reference period the number of days in that gap.<br />

However, if the gap lasts more than 15 days only 15 days may be subtracted.<br />

If the gap spans the end of the tax year you may subtract from your reference<br />

period the part of the gap that falls within the tax year, subject to the other<br />

conditions above.<br />

1.12 If you have more than one change of employment during the tax year, or<br />

the relevant period, you can subtract from your reference period up to 15 days<br />

RDR3 11