Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

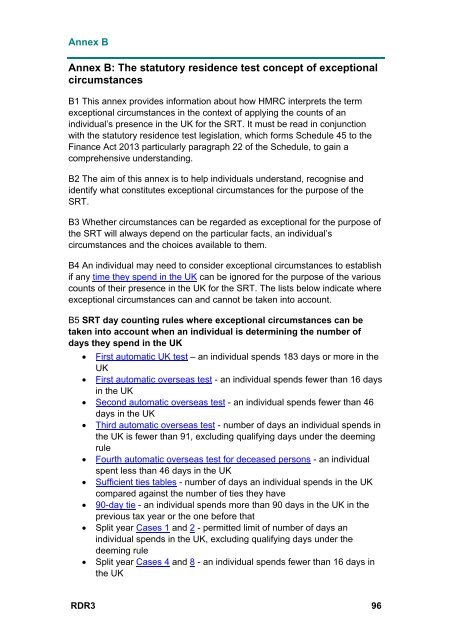

Annex B<br />

Annex B: The statutory residence test concept of exceptional<br />

circumstances<br />

B1 This annex provides information about how <strong>HM</strong>RC interprets the term<br />

exceptional circumstances in the context of applying the counts of an<br />

individual’s presence in the UK for the SRT. It must be read in conjunction<br />

with the statutory residence test legislation, which forms Schedule 45 to the<br />

Finance Act 2013 particularly paragraph 22 of the Schedule, to gain a<br />

comprehensive understanding.<br />

B2 The aim of this annex is to help individuals understand, recognise and<br />

identify what constitutes exceptional circumstances for the purpose of the<br />

SRT.<br />

B3 Whether circumstances can be regarded as exceptional for the purpose of<br />

the SRT will always depend on the particular facts, an individual’s<br />

circumstances and the choices available to them.<br />

B4 An individual may need to consider exceptional circumstances to establish<br />

if any time they spend in the UK can be ignored for the purpose of the various<br />

counts of their presence in the UK for the SRT. The lists below indicate where<br />

exceptional circumstances can and cannot be taken into account.<br />

B5 SRT day counting rules where exceptional circumstances can be<br />

taken into account when an individual is determining the number of<br />

days they spend in the UK<br />

First automatic UK test – an individual spends 183 days or more in the<br />

UK<br />

First automatic overseas test - an individual spends fewer than 16 days<br />

in the UK<br />

Second automatic overseas test - an individual spends fewer than 46<br />

days in the UK<br />

Third automatic overseas test - number of days an individual spends in<br />

the UK is fewer than 91, excluding qualifying days under the deeming<br />

rule<br />

Fourth automatic overseas test for deceased persons - an individual<br />

spent less than 46 days in the UK<br />

Sufficient ties tables - number of days an individual spends in the UK<br />

compared against the number of ties they have<br />

90-day tie - an individual spends more than 90 days in the UK in the<br />

previous tax year or the one before that<br />

Split year Cases 1 and 2 - permitted limit of number of days an<br />

individual spends in the UK, excluding qualifying days under the<br />

deeming rule<br />

Split year Cases 4 and 8 - an individual spends fewer than 16 days in<br />

the UK<br />

RDR3 96