Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

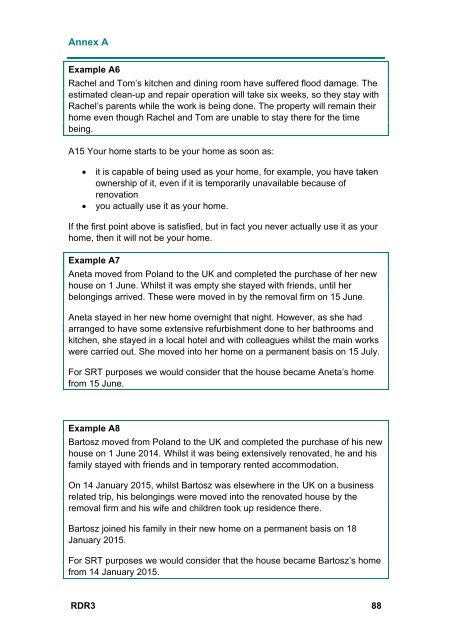

Annex A<br />

Example A6<br />

Rachel and Tom’s kitchen and dining room have suffered flood damage. The<br />

estimated clean-up and repair operation will take six weeks, so they stay with<br />

Rachel’s parents while the work is being done. The property will remain their<br />

home even though Rachel and Tom are unable to stay there for the time<br />

being.<br />

A15 Your home starts to be your home as soon as:<br />

<br />

<br />

it is capable of being used as your home, for example, you have taken<br />

ownership of it, even if it is temporarily unavailable because of<br />

renovation<br />

you actually use it as your home.<br />

If the first point above is satisfied, but in fact you never actually use it as your<br />

home, then it will not be your home.<br />

Example A7<br />

Aneta moved from Poland to the UK and completed the purchase of her new<br />

house on 1 June. Whilst it was empty she stayed with friends, until her<br />

belongings arrived. These were moved in by the removal firm on 15 June.<br />

Aneta stayed in her new home overnight that night. However, as she had<br />

arranged to have some extensive refurbishment done to her bathrooms and<br />

kitchen, she stayed in a local hotel and with colleagues whilst the main works<br />

were carried out. She moved into her home on a permanent basis on 15 July.<br />

For SRT purposes we would consider that the house became Aneta’s home<br />

from 15 June.<br />

Example A8<br />

Bartosz moved from Poland to the UK and completed the purchase of his new<br />

house on 1 June 2014. Whilst it was being extensively renovated, he and his<br />

family stayed with friends and in temporary rented accommodation.<br />

On 14 January 2015, whilst Bartosz was elsewhere in the UK on a business<br />

related trip, his belongings were moved into the renovated house by the<br />

removal firm and his wife and children took up residence there.<br />

Bartosz joined his family in their new home on a permanent basis on 18<br />

January 2015.<br />

For SRT purposes we would consider that the house became Bartosz’s home<br />

from 14 January 2015.<br />

RDR3 88