Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

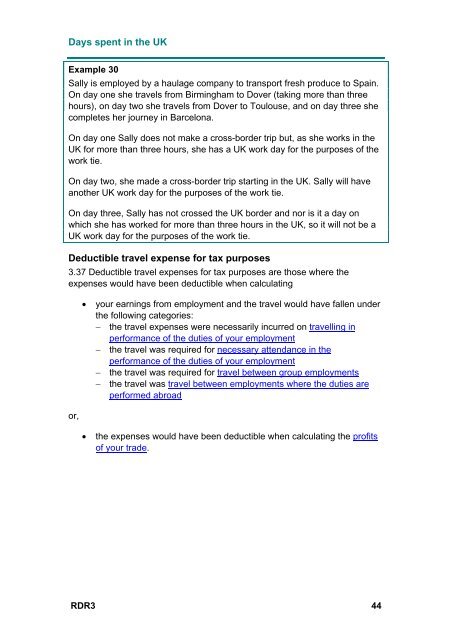

Days spent in the UK<br />

Example 30<br />

Sally is employed by a haulage company to transport fresh produce to Spain.<br />

On day one she travels from Birmingham to Dover (taking more than three<br />

hours), on day two she travels from Dover to Toulouse, and on day three she<br />

completes her journey in Barcelona.<br />

On day one Sally does not make a cross-border trip but, as she works in the<br />

UK for more than three hours, she has a UK work day for the purposes of the<br />

work tie.<br />

On day two, she made a cross-border trip starting in the UK. Sally will have<br />

another UK work day for the purposes of the work tie.<br />

On day three, Sally has not crossed the UK border and nor is it a day on<br />

which she has worked for more than three hours in the UK, so it will not be a<br />

UK work day for the purposes of the work tie.<br />

Deductible travel expense for tax purposes<br />

3.37 Deductible travel expenses for tax purposes are those where the<br />

expenses would have been deductible when calculating<br />

<br />

your earnings from employment and the travel would have fallen under<br />

the following categories:<br />

the travel expenses were necessarily incurred on travelling in<br />

performance of the duties of your employment<br />

the travel was required for necessary attendance in the<br />

performance of the duties of your employment<br />

the travel was required for travel between group employments<br />

the travel was travel between employments where the duties are<br />

performed abroad<br />

or,<br />

<br />

the expenses would have been deductible when calculating the profits<br />

of your trade.<br />

RDR3 44