Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

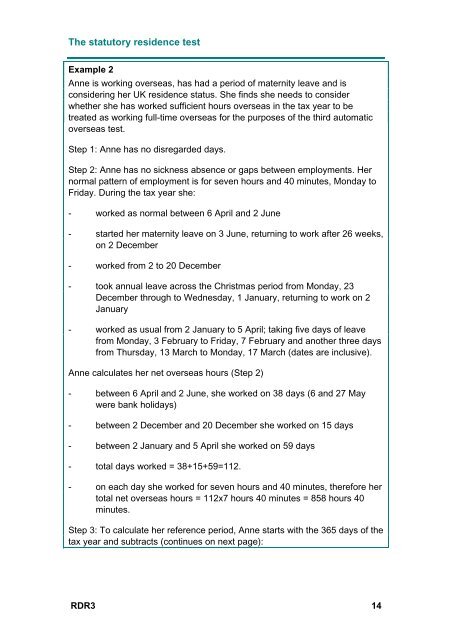

The statutory residence test<br />

Example 2<br />

Anne is working overseas, has had a period of maternity leave and is<br />

considering her UK residence status. She finds she needs to consider<br />

whether she has worked sufficient hours overseas in the tax year to be<br />

treated as working full-time overseas for the purposes of the third automatic<br />

overseas test.<br />

Step 1: Anne has no disregarded days.<br />

Step 2: Anne has no sickness absence or gaps between employments. Her<br />

normal pattern of employment is for seven hours and 40 minutes, Monday to<br />

Friday. During the tax year she:<br />

- worked as normal between 6 April and 2 June<br />

- started her maternity leave on 3 June, returning to work after 26 weeks,<br />

on 2 December<br />

- worked from 2 to 20 December<br />

- took annual leave across the Christmas period from Monday, 23<br />

December through to Wednesday, 1 January, returning to work on 2<br />

January<br />

- worked as usual from 2 January to 5 April; taking five days of leave<br />

from Monday, 3 February to Friday, 7 February and another three days<br />

from Thursday, 13 March to Monday, 17 March (dates are inclusive).<br />

Anne calculates her net overseas hours (Step 2)<br />

- between 6 April and 2 June, she worked on 38 days (6 and 27 May<br />

were bank holidays)<br />

- between 2 December and 20 December she worked on 15 days<br />

- between 2 January and 5 April she worked on 59 days<br />

- total days worked = 38+15+59=112.<br />

- on each day she worked for seven hours and 40 minutes, therefore her<br />

total net overseas hours = 112x7 hours 40 minutes = 858 hours 40<br />

minutes.<br />

Step 3: To calculate her reference period, Anne starts with the 365 days of the<br />

tax year and subtracts (continues on next page):<br />

RDR3 14