Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The statutory residence test<br />

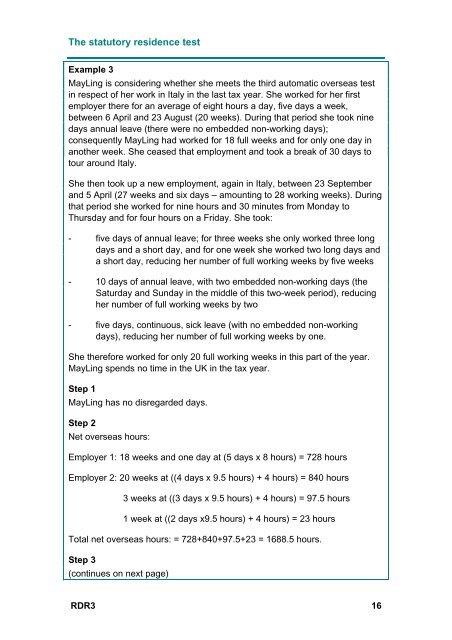

Example 3<br />

MayLing is considering whether she meets the third automatic overseas test<br />

in respect of her work in Italy in the last tax year. She worked for her first<br />

employer there for an average of eight hours a day, five days a week,<br />

between 6 April and 23 August (20 weeks). During that period she took nine<br />

days annual leave (there were no embedded non-working days);<br />

consequently MayLing had worked for 18 full weeks and for only one day in<br />

another week. She ceased that employment and took a break of 30 days to<br />

tour around Italy.<br />

She then took up a new employment, again in Italy, between 23 September<br />

and 5 April (27 weeks and six days – amounting to 28 working weeks). During<br />

that period she worked for nine hours and 30 minutes from Monday to<br />

Thursday and for four hours on a Friday. She took:<br />

- five days of annual leave; for three weeks she only worked three long<br />

days and a short day, and for one week she worked two long days and<br />

a short day, reducing her number of full working weeks by five weeks<br />

- 10 days of annual leave, with two embedded non-working days (the<br />

Saturday and Sunday in the middle of this two-week period), reducing<br />

her number of full working weeks by two<br />

- five days, continuous, sick leave (with no embedded non-working<br />

days), reducing her number of full working weeks by one.<br />

She therefore worked for only 20 full working weeks in this part of the year.<br />

MayLing spends no time in the UK in the tax year.<br />

Step 1<br />

MayLing has no disregarded days.<br />

Step 2<br />

Net overseas hours:<br />

Employer 1: 18 weeks and one day at (5 days x 8 hours) = 728 hours<br />

Employer 2: 20 weeks at ((4 days x 9.5 hours) + 4 hours) = 840 hours<br />

3 weeks at ((3 days x 9.5 hours) + 4 hours) = 97.5 hours<br />

1 week at ((2 days x9.5 hours) + 4 hours) = 23 hours<br />

Total net overseas hours: = 728+840+97.5+23 = 1688.5 hours.<br />

Step 3<br />

(continues on next page)<br />

RDR3 16