Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

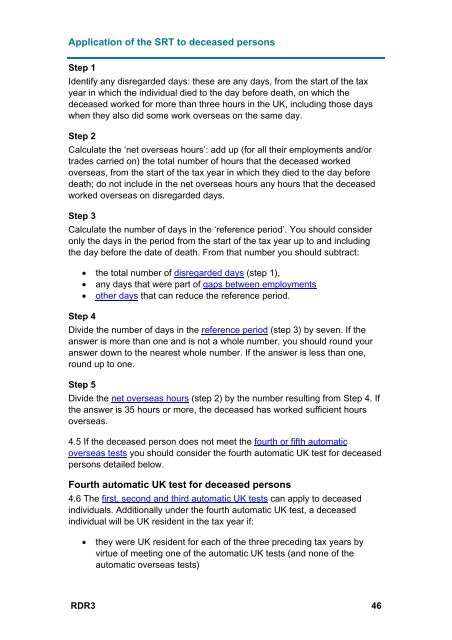

Application of the SRT to deceased persons<br />

Step 1<br />

Identify any disregarded days: these are any days, from the start of the tax<br />

year in which the individual died to the day before death, on which the<br />

deceased worked for more than three hours in the UK, including those days<br />

when they also did some work overseas on the same day.<br />

Step 2<br />

Calculate the ‘net overseas hours’: add up (for all their employments and/or<br />

trades carried on) the total number of hours that the deceased worked<br />

overseas, from the start of the tax year in which they died to the day before<br />

death; do not include in the net overseas hours any hours that the deceased<br />

worked overseas on disregarded days.<br />

Step 3<br />

Calculate the number of days in the ‘reference period’. You should consider<br />

only the days in the period from the start of the tax year up to and including<br />

the day before the date of death. From that number you should subtract:<br />

the total number of disregarded days (step 1),<br />

any days that were part of gaps between employments<br />

other days that can reduce the reference period.<br />

Step 4<br />

Divide the number of days in the reference period (step 3) by seven. If the<br />

answer is more than one and is not a whole number, you should round your<br />

answer down to the nearest whole number. If the answer is less than one,<br />

round up to one.<br />

Step 5<br />

Divide the net overseas hours (step 2) by the number resulting from Step 4. If<br />

the answer is 35 hours or more, the deceased has worked sufficient hours<br />

overseas.<br />

4.5 If the deceased person does not meet the fourth or fifth automatic<br />

overseas tests you should consider the fourth automatic UK test for deceased<br />

persons detailed below.<br />

Fourth automatic UK test for deceased persons<br />

4.6 The first, second and third automatic UK tests can apply to deceased<br />

individuals. Additionally under the fourth automatic UK test, a deceased<br />

individual will be UK resident in the tax year if:<br />

<br />

they were UK resident for each of the three preceding tax years by<br />

virtue of meeting one of the automatic UK tests (and none of the<br />

automatic overseas tests)<br />

RDR3 46