Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The statutory residence test<br />

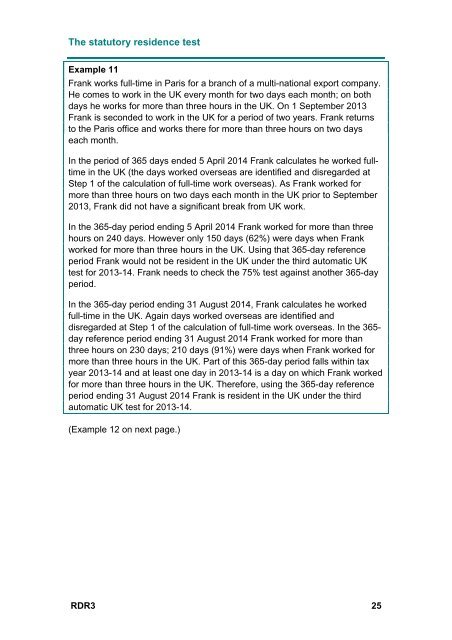

Example 11<br />

Frank works full-time in Paris for a branch of a multi-national export company.<br />

He comes to work in the UK every month for two days each month; on both<br />

days he works for more than three hours in the UK. On 1 September 2013<br />

Frank is seconded to work in the UK for a period of two years. Frank returns<br />

to the Paris office and works there for more than three hours on two days<br />

each month.<br />

In the period of 365 days ended 5 April 2014 Frank calculates he worked fulltime<br />

in the UK (the days worked overseas are identified and disregarded at<br />

Step 1 of the calculation of full-time work overseas). As Frank worked for<br />

more than three hours on two days each month in the UK prior to September<br />

2013, Frank did not have a significant break from UK work.<br />

In the 365-day period ending 5 April 2014 Frank worked for more than three<br />

hours on 240 days. However only 150 days (62%) were days when Frank<br />

worked for more than three hours in the UK. Using that 365-day reference<br />

period Frank would not be resident in the UK under the third automatic UK<br />

test for 2013-14. Frank needs to check the 75% test against another 365-day<br />

period.<br />

In the 365-day period ending 31 August 2014, Frank calculates he worked<br />

full-time in the UK. Again days worked overseas are identified and<br />

disregarded at Step 1 of the calculation of full-time work overseas. In the 365-<br />

day reference period ending 31 August 2014 Frank worked for more than<br />

three hours on 230 days; 210 days (91%) were days when Frank worked for<br />

more than three hours in the UK. Part of this 365-day period falls within tax<br />

year 2013-14 and at least one day in 2013-14 is a day on which Frank worked<br />

for more than three hours in the UK. Therefore, using the 365-day reference<br />

period ending 31 August 2014 Frank is resident in the UK under the third<br />

automatic UK test for 2013-14.<br />

(Example 12 on next page.)<br />

RDR3 25