Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

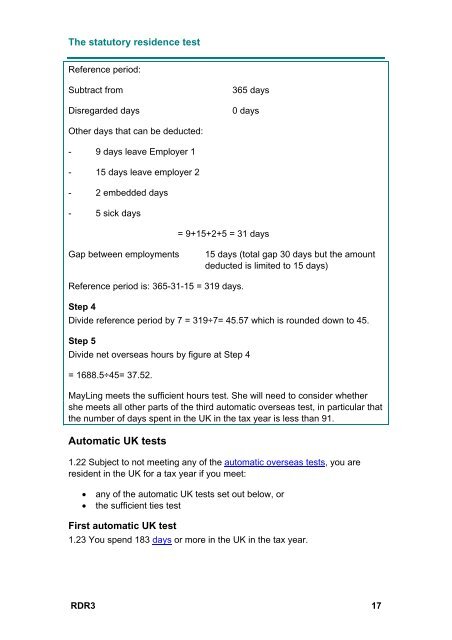

The statutory residence test<br />

Reference period:<br />

Subtract from<br />

Disregarded days<br />

365 days<br />

0 days<br />

Other days that can be deducted:<br />

- 9 days leave Employer 1<br />

- 15 days leave employer 2<br />

- 2 embedded days<br />

- 5 sick days<br />

= 9+15+2+5 = 31 days<br />

Gap between employments<br />

15 days (total gap 30 days but the amount<br />

deducted is limited to 15 days)<br />

Reference period is: 365-31-15 = 319 days.<br />

Step 4<br />

Divide reference period by 7 = 319÷7= 45.57 which is rounded down to 45.<br />

Step 5<br />

Divide net overseas hours by figure at Step 4<br />

= 1688.5÷45= 37.52.<br />

MayLing meets the sufficient hours test. She will need to consider whether<br />

she meets all other parts of the third automatic overseas test, in particular that<br />

the number of days spent in the UK in the tax year is less than 91.<br />

Automatic UK tests<br />

1.22 Subject to not meeting any of the automatic overseas tests, you are<br />

resident in the UK for a tax year if you meet:<br />

<br />

<br />

any of the automatic UK tests set out below, or<br />

the sufficient ties test<br />

First automatic UK test<br />

1.23 You spend 183 days or more in the UK in the tax year.<br />

RDR3 17