Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

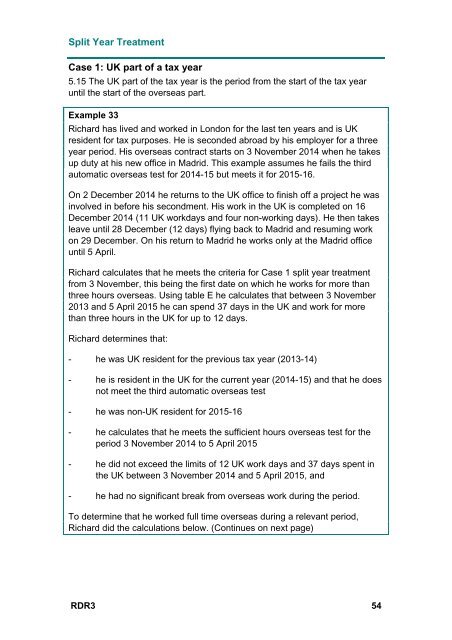

Split Year Treatment<br />

Case 1: UK part of a tax year<br />

5.15 The UK part of the tax year is the period from the start of the tax year<br />

until the start of the overseas part.<br />

Example 33<br />

Richard has lived and worked in London for the last ten years and is UK<br />

resident for tax purposes. He is seconded abroad by his employer for a three<br />

year period. His overseas contract starts on 3 November 2014 when he takes<br />

up duty at his new office in Madrid. This example assumes he fails the third<br />

automatic overseas test for 2014-15 but meets it for 2015-16.<br />

On 2 December 2014 he returns to the UK office to finish off a project he was<br />

involved in before his secondment. His work in the UK is completed on 16<br />

December 2014 (11 UK workdays and four non-working days). He then takes<br />

leave until 28 December (12 days) flying back to Madrid and resuming work<br />

on 29 December. On his return to Madrid he works only at the Madrid office<br />

until 5 April.<br />

Richard calculates that he meets the criteria for Case 1 split year treatment<br />

from 3 November, this being the first date on which he works for more than<br />

three hours overseas. Using table E he calculates that between 3 November<br />

2013 and 5 April 2015 he can spend 37 days in the UK and work for more<br />

than three hours in the UK for up to 12 days.<br />

Richard determines that:<br />

- he was UK resident for the previous tax year (2013-14)<br />

- he is resident in the UK for the current year (2014-15) and that he does<br />

not meet the third automatic overseas test<br />

- he was non-UK resident for 2015-16<br />

- he calculates that he meets the sufficient hours overseas test for the<br />

period 3 November 2014 to 5 April 2015<br />

- he did not exceed the limits of 12 UK work days and 37 days spent in<br />

the UK between 3 November 2014 and 5 April 2015, and<br />

- he had no significant break from overseas work during the period.<br />

To determine that he worked full time overseas during a relevant period,<br />

Richard did the calculations below. (Continues on next page)<br />

RDR3 54