Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

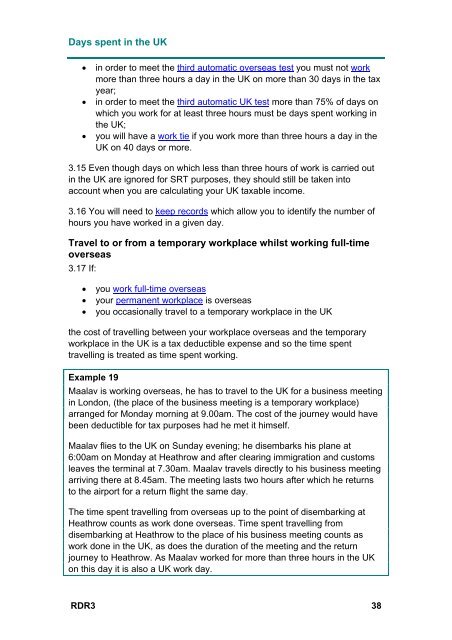

Days spent in the UK<br />

<br />

<br />

<br />

in order to meet the third automatic overseas test you must not work<br />

more than three hours a day in the UK on more than 30 days in the tax<br />

year;<br />

in order to meet the third automatic UK test more than 75% of days on<br />

which you work for at least three hours must be days spent working in<br />

the UK;<br />

you will have a work tie if you work more than three hours a day in the<br />

UK on 40 days or more.<br />

3.15 Even though days on which less than three hours of work is carried out<br />

in the UK are ignored for SRT purposes, they should still be taken into<br />

account when you are calculating your UK taxable income.<br />

3.16 You will need to keep records which allow you to identify the number of<br />

hours you have worked in a given day.<br />

Travel to or from a temporary workplace whilst working full-time<br />

overseas<br />

3.17 If:<br />

<br />

<br />

<br />

you work full-time overseas<br />

your permanent workplace is overseas<br />

you occasionally travel to a temporary workplace in the UK<br />

the cost of travelling between your workplace overseas and the temporary<br />

workplace in the UK is a tax deductible expense and so the time spent<br />

travelling is treated as time spent working.<br />

Example 19<br />

Maalav is working overseas, he has to travel to the UK for a business meeting<br />

in London, (the place of the business meeting is a temporary workplace)<br />

arranged for Monday morning at 9.00am. The cost of the journey would have<br />

been deductible for tax purposes had he met it himself.<br />

Maalav flies to the UK on Sunday evening; he disembarks his plane at<br />

6:00am on Monday at Heathrow and after clearing immigration and customs<br />

leaves the terminal at 7.30am. Maalav travels directly to his business meeting<br />

arriving there at 8.45am. The meeting lasts two hours after which he returns<br />

to the airport for a return flight the same day.<br />

The time spent travelling from overseas up to the point of disembarking at<br />

Heathrow counts as work done overseas. Time spent travelling from<br />

disembarking at Heathrow to the place of his business meeting counts as<br />

work done in the UK, as does the duration of the meeting and the return<br />

journey to Heathrow. As Maalav worked for more than three hours in the UK<br />

on this day it is also a UK work day.<br />

RDR3 38