Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

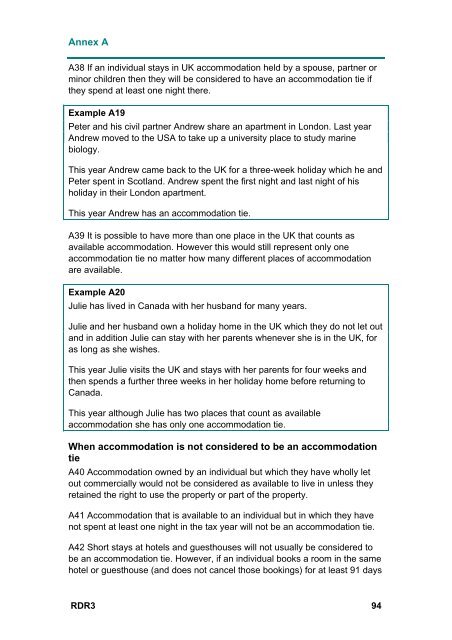

Annex A<br />

A38 If an individual stays in UK accommodation held by a spouse, partner or<br />

minor children then they will be considered to have an accommodation tie if<br />

they spend at least one night there.<br />

Example A19<br />

Peter and his civil partner Andrew share an apartment in London. Last year<br />

Andrew moved to the USA to take up a university place to study marine<br />

biology.<br />

This year Andrew came back to the UK for a three-week holiday which he and<br />

Peter spent in Scotland. Andrew spent the first night and last night of his<br />

holiday in their London apartment.<br />

This year Andrew has an accommodation tie.<br />

A39 It is possible to have more than one place in the UK that counts as<br />

available accommodation. However this would still represent only one<br />

accommodation tie no matter how many different places of accommodation<br />

are available.<br />

Example A20<br />

Julie has lived in Canada with her husband for many years.<br />

Julie and her husband own a holiday home in the UK which they do not let out<br />

and in addition Julie can stay with her parents whenever she is in the UK, for<br />

as long as she wishes.<br />

This year Julie visits the UK and stays with her parents for four weeks and<br />

then spends a further three weeks in her holiday home before returning to<br />

Canada.<br />

This year although Julie has two places that count as available<br />

accommodation she has only one accommodation tie.<br />

When accommodation is not considered to be an accommodation<br />

tie<br />

A40 Accommodation owned by an individual but which they have wholly let<br />

out commercially would not be considered as available to live in unless they<br />

retained the right to use the property or part of the property.<br />

A41 Accommodation that is available to an individual but in which they have<br />

not spent at least one night in the tax year will not be an accommodation tie.<br />

A42 Short stays at hotels and guesthouses will not usually be considered to<br />

be an accommodation tie. However, if an individual books a room in the same<br />

hotel or guesthouse (and does not cancel those bookings) for at least 91 days<br />

RDR3 94