Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

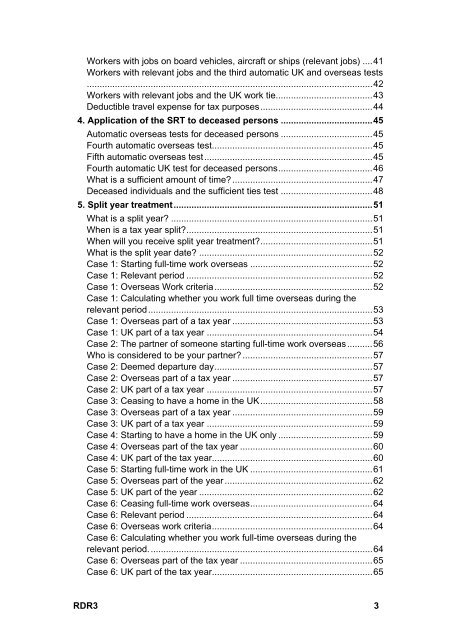

Workers with jobs on board vehicles, aircraft or ships (relevant jobs) ....41<br />

Workers with relevant jobs and the third automatic UK and overseas tests<br />

................................................................................................................42<br />

Workers with relevant jobs and the UK work tie......................................43<br />

Deductible travel expense for tax purposes............................................44<br />

4. Application of the SRT to deceased persons ....................................45<br />

Automatic overseas tests for deceased persons ....................................45<br />

Fourth automatic overseas test...............................................................45<br />

Fifth automatic overseas test..................................................................45<br />

Fourth automatic UK test for deceased persons.....................................46<br />

What is a sufficient amount of time? .......................................................47<br />

Deceased individuals and the sufficient ties test ....................................48<br />

5. Split year treatment..............................................................................51<br />

What is a split year? ...............................................................................51<br />

When is a tax year split?.........................................................................51<br />

When will you receive split year treatment?............................................51<br />

What is the split year date? ....................................................................52<br />

Case 1: Starting full-time work overseas ................................................52<br />

Case 1: Relevant period .........................................................................52<br />

Case 1: Overseas Work criteria..............................................................52<br />

Case 1: Calculating whether you work full time overseas during the<br />

relevant period........................................................................................53<br />

Case 1: Overseas part of a tax year .......................................................53<br />

Case 1: UK part of a tax year .................................................................54<br />

Case 2: The partner of someone starting full-time work overseas..........56<br />

Who is considered to be your partner? ...................................................57<br />

Case 2: Deemed departure day..............................................................57<br />

Case 2: Overseas part of a tax year .......................................................57<br />

Case 2: UK part of a tax year .................................................................57<br />

Case 3: Ceasing to have a home in the UK............................................58<br />

Case 3: Overseas part of a tax year .......................................................59<br />

Case 3: UK part of a tax year .................................................................59<br />

Case 4: Starting to have a home in the UK only .....................................59<br />

Case 4: Overseas part of the tax year ....................................................60<br />

Case 4: UK part of the tax year...............................................................60<br />

Case 5: Starting full-time work in the UK ................................................61<br />

Case 5: Overseas part of the year ..........................................................62<br />

Case 5: UK part of the year ....................................................................62<br />

Case 6: Ceasing full-time work overseas................................................64<br />

Case 6: Relevant period .........................................................................64<br />

Case 6: Overseas work criteria...............................................................64<br />

Case 6: Calculating whether you work full-time overseas during the<br />

relevant period........................................................................................64<br />

Case 6: Overseas part of the tax year ....................................................65<br />

Case 6: UK part of the tax year...............................................................65<br />

RDR3 3