Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

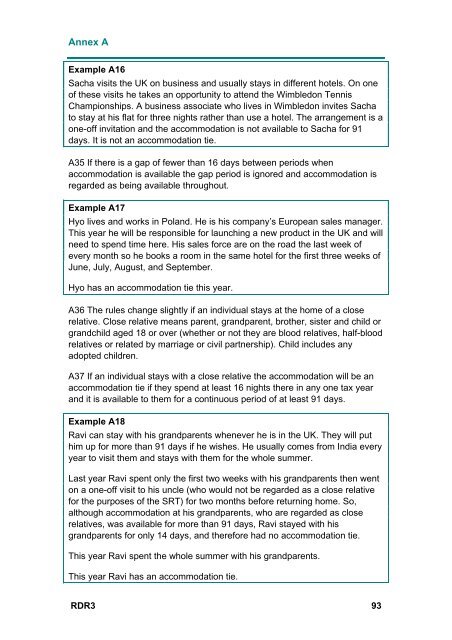

Annex A<br />

Example A16<br />

Sacha visits the UK on business and usually stays in different hotels. On one<br />

of these visits he takes an opportunity to attend the Wimbledon Tennis<br />

Championships. A business associate who lives in Wimbledon invites Sacha<br />

to stay at his flat for three nights rather than use a hotel. The arrangement is a<br />

one-off invitation and the accommodation is not available to Sacha for 91<br />

days. It is not an accommodation tie.<br />

A35 If there is a gap of fewer than 16 days between periods when<br />

accommodation is available the gap period is ignored and accommodation is<br />

regarded as being available throughout.<br />

Example A17<br />

Hyo lives and works in Poland. He is his company’s European sales manager.<br />

This year he will be responsible for launching a new product in the UK and will<br />

need to spend time here. His sales force are on the road the last week of<br />

every month so he books a room in the same hotel for the first three weeks of<br />

June, July, August, and September.<br />

Hyo has an accommodation tie this year.<br />

A36 The rules change slightly if an individual stays at the home of a close<br />

relative. Close relative means parent, grandparent, brother, sister and child or<br />

grandchild aged 18 or over (whether or not they are blood relatives, half-blood<br />

relatives or related by marriage or civil partnership). Child includes any<br />

adopted children.<br />

A37 If an individual stays with a close relative the accommodation will be an<br />

accommodation tie if they spend at least 16 nights there in any one tax year<br />

and it is available to them for a continuous period of at least 91 days.<br />

Example A18<br />

Ravi can stay with his grandparents whenever he is in the UK. They will put<br />

him up for more than 91 days if he wishes. He usually comes from India every<br />

year to visit them and stays with them for the whole summer.<br />

Last year Ravi spent only the first two weeks with his grandparents then went<br />

on a one-off visit to his uncle (who would not be regarded as a close relative<br />

for the purposes of the SRT) for two months before returning home. So,<br />

although accommodation at his grandparents, who are regarded as close<br />

relatives, was available for more than 91 days, Ravi stayed with his<br />

grandparents for only 14 days, and therefore had no accommodation tie.<br />

This year Ravi spent the whole summer with his grandparents.<br />

This year Ravi has an accommodation tie.<br />

RDR3 93