Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

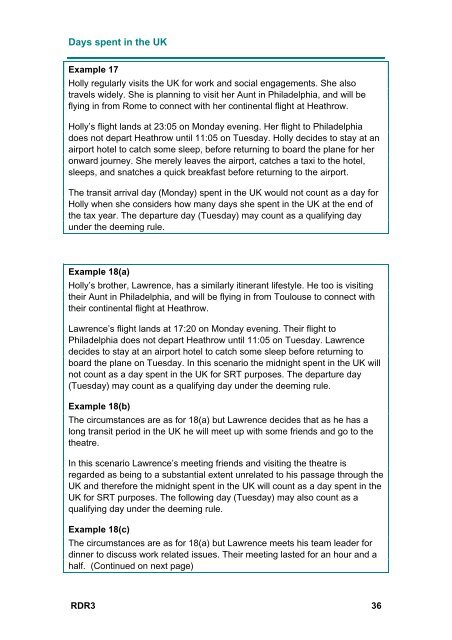

Days spent in the UK<br />

Example 17<br />

Holly regularly visits the UK for work and social engagements. She also<br />

travels widely. She is planning to visit her Aunt in Philadelphia, and will be<br />

flying in from Rome to connect with her continental flight at Heathrow.<br />

Holly’s flight lands at 23:05 on Monday evening. Her flight to Philadelphia<br />

does not depart Heathrow until 11:05 on Tuesday. Holly decides to stay at an<br />

airport hotel to catch some sleep, before returning to board the plane for her<br />

onward journey. She merely leaves the airport, catches a taxi to the hotel,<br />

sleeps, and snatches a quick breakfast before returning to the airport.<br />

The transit arrival day (Monday) spent in the UK would not count as a day for<br />

Holly when she considers how many days she spent in the UK at the end of<br />

the tax year. The departure day (Tuesday) may count as a qualifying day<br />

under the deeming rule.<br />

Example 18(a)<br />

Holly’s brother, Lawrence, has a similarly itinerant lifestyle. He too is visiting<br />

their Aunt in Philadelphia, and will be flying in from Toulouse to connect with<br />

their continental flight at Heathrow.<br />

Lawrence’s flight lands at 17:20 on Monday evening. Their flight to<br />

Philadelphia does not depart Heathrow until 11:05 on Tuesday. Lawrence<br />

decides to stay at an airport hotel to catch some sleep before returning to<br />

board the plane on Tuesday. In this scenario the midnight spent in the UK will<br />

not count as a day spent in the UK for SRT purposes. The departure day<br />

(Tuesday) may count as a qualifying day under the deeming rule.<br />

Example 18(b)<br />

The circumstances are as for 18(a) but Lawrence decides that as he has a<br />

long transit period in the UK he will meet up with some friends and go to the<br />

theatre.<br />

In this scenario Lawrence’s meeting friends and visiting the theatre is<br />

regarded as being to a substantial extent unrelated to his passage through the<br />

UK and therefore the midnight spent in the UK will count as a day spent in the<br />

UK for SRT purposes. The following day (Tuesday) may also count as a<br />

qualifying day under the deeming rule.<br />

Example 18(c)<br />

The circumstances are as for 18(a) but Lawrence meets his team leader for<br />

dinner to discuss work related issues. Their meeting lasted for an hour and a<br />

half. (Continued on next page)<br />

RDR3 36