Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

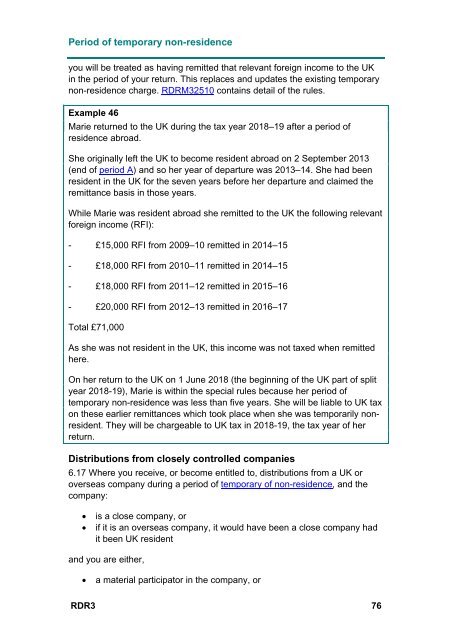

Period of temporary non-residence<br />

you will be treated as having remitted that relevant foreign income to the UK<br />

in the period of your return. This replaces and updates the existing temporary<br />

non-residence charge. RDRM32510 contains detail of the rules.<br />

Example 46<br />

Marie returned to the UK during the tax year 2018–19 after a period of<br />

residence abroad.<br />

She originally left the UK to become resident abroad on 2 September 2013<br />

(end of period A) and so her year of departure was 2013–14. She had been<br />

resident in the UK for the seven years before her departure and claimed the<br />

remittance basis in those years.<br />

While Marie was resident abroad she remitted to the UK the following relevant<br />

foreign income (RFI):<br />

- £15,000 RFI from 2009–10 remitted in 2014–15<br />

- £18,000 RFI from 2010–11 remitted in 2014–15<br />

- £18,000 RFI from 2011–12 remitted in 2015–16<br />

- £20,000 RFI from 2012–13 remitted in 2016–17<br />

Total £71,000<br />

As she was not resident in the UK, this income was not taxed when remitted<br />

here.<br />

On her return to the UK on 1 June 2018 (the beginning of the UK part of split<br />

year 2018-19), Marie is within the special rules because her period of<br />

temporary non-residence was less than five years. She will be liable to UK tax<br />

on these earlier remittances which took place when she was temporarily nonresident.<br />

They will be chargeable to UK tax in 2018-19, the tax year of her<br />

return.<br />

Distributions from closely controlled companies<br />

6.17 Where you receive, or become entitled to, distributions from a UK or<br />

overseas company during a period of temporary of non-residence, and the<br />

company:<br />

<br />

<br />

is a close company, or<br />

if it is an overseas company, it would have been a close company had<br />

it been UK resident<br />

and you are either,<br />

<br />

a material participator in the company, or<br />

RDR3 76