Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The statutory residence test<br />

30-day presence rules<br />

1.32 The effect of the sufficient amount of time and permitted amount of time<br />

rules is that, for the purposes of the second automatic UK test, you can<br />

disregard any home where you are present on fewer than 30 separate days<br />

(individual or consecutive) in the tax year. So, for example, if you are present<br />

at your overseas home on fewer than 30 separate days you will have spent no<br />

more than the permitted amount of time there and you can disregard that<br />

home for the purposes of this automatic UK test. Similarly if you spend fewer<br />

than 30 days in a UK home you will not have spent a sufficient amount of time<br />

there and you can disregard that home for the purposes of this automatic UK<br />

test.<br />

1.33 The 30-day presence rules only apply in respect of time you spend in a<br />

place while it is your home. So, for example, if you view a place which you<br />

later make your home, the day of your viewing would not count towards the<br />

sufficient or permitted amount of time tests.<br />

1.34 You are present at your home on any day that you have been present in<br />

it in person, no matter how short a period you were there. It is not necessary<br />

to be there at midnight in order for the day to be counted.<br />

1.35 The 30-day presence rules operate on each home separately and<br />

independently.<br />

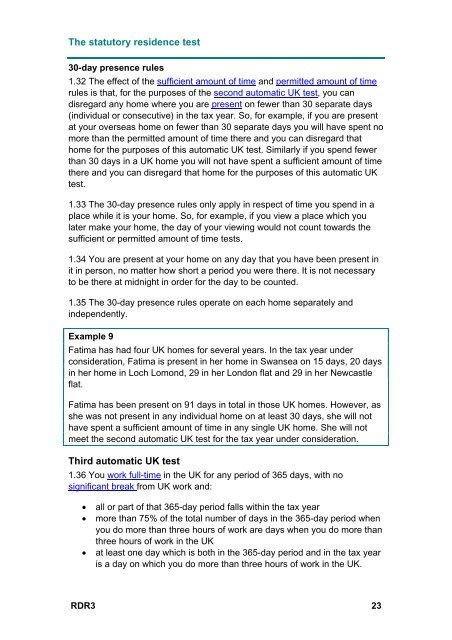

Example 9<br />

Fatima has had four UK homes for several years. In the tax year under<br />

consideration, Fatima is present in her home in Swansea on 15 days, 20 days<br />

in her home in Loch Lomond, 29 in her London flat and 29 in her Newcastle<br />

flat.<br />

Fatima has been present on 91 days in total in those UK homes. However, as<br />

she was not present in any individual home on at least 30 days, she will not<br />

have spent a sufficient amount of time in any single UK home. She will not<br />

meet the second automatic UK test for the tax year under consideration.<br />

Third automatic UK test<br />

1.36 You work full-time in the UK for any period of 365 days, with no<br />

significant break from UK work and:<br />

<br />

<br />

<br />

all or part of that 365-day period falls within the tax year<br />

more than 75% of the total number of days in the 365-day period when<br />

you do more than three hours of work are days when you do more than<br />

three hours of work in the UK<br />

at least one day which is both in the 365-day period and in the tax year<br />

is a day on which you do more than three hours of work in the UK.<br />

RDR3 23