Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The statutory residence test<br />

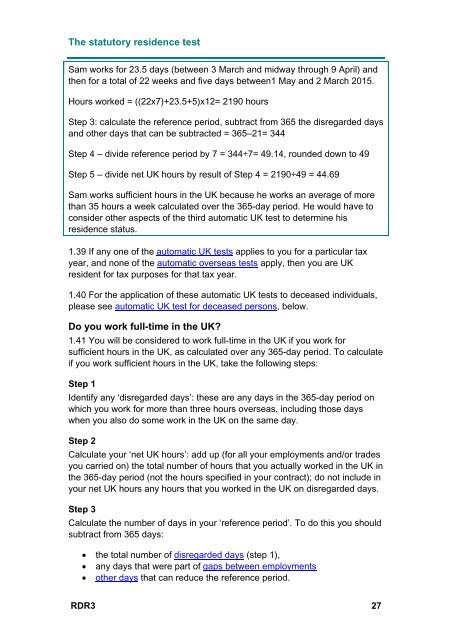

Sam works for 23.5 days (between 3 March and midway through 9 April) and<br />

then for a total of 22 weeks and five days between1 May and 2 March 2015.<br />

Hours worked = ((22x7)+23.5+5)x12= 2190 hours<br />

Step 3: calculate the reference period, subtract from 365 the disregarded days<br />

and other days that can be subtracted = 365–21= 344<br />

Step 4 – divide reference period by 7 = 344÷7= 49.14, rounded down to 49<br />

Step 5 – divide net UK hours by result of Step 4 = 2190÷49 = 44.69<br />

Sam works sufficient hours in the UK because he works an average of more<br />

than 35 hours a week calculated over the 365-day period. He would have to<br />

consider other aspects of the third automatic UK test to determine his<br />

residence status.<br />

1.39 If any one of the automatic UK tests applies to you for a particular tax<br />

year, and none of the automatic overseas tests apply, then you are UK<br />

resident for tax purposes for that tax year.<br />

1.40 For the application of these automatic UK tests to deceased individuals,<br />

please see automatic UK test for deceased persons, below.<br />

Do you work full-time in the UK?<br />

1.41 You will be considered to work full-time in the UK if you work for<br />

sufficient hours in the UK, as calculated over any 365-day period. To calculate<br />

if you work sufficient hours in the UK, take the following steps:<br />

Step 1<br />

Identify any ‘disregarded days’: these are any days in the 365-day period on<br />

which you work for more than three hours overseas, including those days<br />

when you also do some work in the UK on the same day.<br />

Step 2<br />

Calculate your ‘net UK hours’: add up (for all your employments and/or trades<br />

you carried on) the total number of hours that you actually worked in the UK in<br />

the 365-day period (not the hours specified in your contract); do not include in<br />

your net UK hours any hours that you worked in the UK on disregarded days.<br />

Step 3<br />

Calculate the number of days in your ‘reference period’. To do this you should<br />

subtract from 365 days:<br />

the total number of disregarded days (step 1),<br />

any days that were part of gaps between employments<br />

other days that can reduce the reference period.<br />

RDR3 27