Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

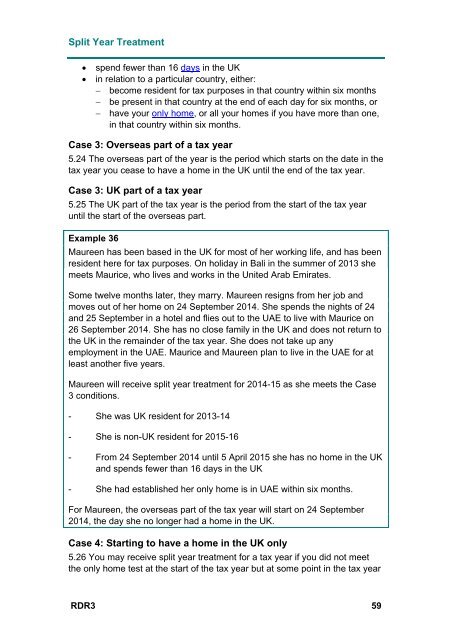

Split Year Treatment<br />

<br />

<br />

spend fewer than 16 days in the UK<br />

in relation to a particular country, either:<br />

become resident for tax purposes in that country within six months<br />

be present in that country at the end of each day for six months, or<br />

have your only home, or all your homes if you have more than one,<br />

in that country within six months.<br />

Case 3: Overseas part of a tax year<br />

5.24 The overseas part of the year is the period which starts on the date in the<br />

tax year you cease to have a home in the UK until the end of the tax year.<br />

Case 3: UK part of a tax year<br />

5.25 The UK part of the tax year is the period from the start of the tax year<br />

until the start of the overseas part.<br />

Example 36<br />

Maureen has been based in the UK for most of her working life, and has been<br />

resident here for tax purposes. On holiday in Bali in the summer of 2013 she<br />

meets Maurice, who lives and works in the United Arab Emirates.<br />

Some twelve months later, they marry. Maureen resigns from her job and<br />

moves out of her home on 24 September 2014. She spends the nights of 24<br />

and 25 September in a hotel and flies out to the UAE to live with Maurice on<br />

26 September 2014. She has no close family in the UK and does not return to<br />

the UK in the remainder of the tax year. She does not take up any<br />

employment in the UAE. Maurice and Maureen plan to live in the UAE for at<br />

least another five years.<br />

Maureen will receive split year treatment for 2014-15 as she meets the Case<br />

3 conditions.<br />

- She was UK resident for 2013-14<br />

- She is non-UK resident for 2015-16<br />

- From 24 September 2014 until 5 April 2015 she has no home in the UK<br />

and spends fewer than 16 days in the UK<br />

- She had established her only home is in UAE within six months.<br />

For Maureen, the overseas part of the tax year will start on 24 September<br />

2014, the day she no longer had a home in the UK.<br />

Case 4: Starting to have a home in the UK only<br />

5.26 You may receive split year treatment for a tax year if you did not meet<br />

the only home test at the start of the tax year but at some point in the tax year<br />

RDR3 59