Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Period of temporary non-residence<br />

<br />

<br />

remuneration rules. EIM45805 and EIM45810 contain detail of the<br />

rules.<br />

Certain lump sums paid by UK pension schemes in respect of which a<br />

charge on receipt is removed by a double taxation agreement. Detailed<br />

guidance will be provided in due course and a link to that guidance will<br />

appear here.<br />

Certain taxable property deemed income and gains of a pension<br />

scheme charged to tax on a scheme member. This replaces and<br />

updates the existing temporary non-residence charge. Detailed<br />

guidance will be provided in due course and a link to that guidance will<br />

appear here.<br />

6.15 Where you receive, or become entitled to, any of the above during a<br />

period of temporary non-residence you will be taxed as if you received, or<br />

became entitled to, them in the period of your return.<br />

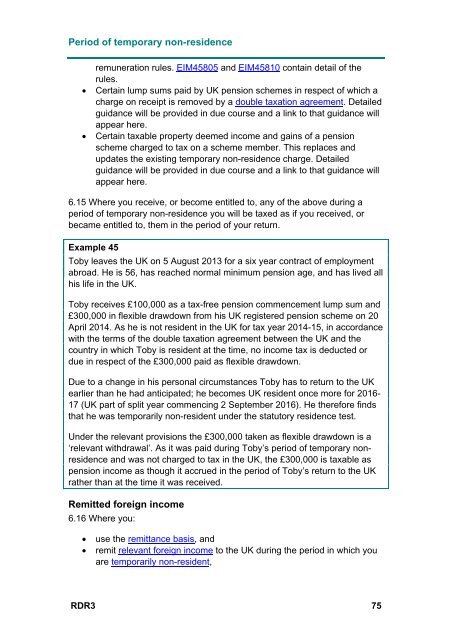

Example 45<br />

Toby leaves the UK on 5 August 2013 for a six year contract of employment<br />

abroad. He is 56, has reached normal minimum pension age, and has lived all<br />

his life in the UK.<br />

Toby receives £100,000 as a tax-free pension commencement lump sum and<br />

£300,000 in flexible drawdown from his UK registered pension scheme on 20<br />

April 2014. As he is not resident in the UK for tax year 2014-15, in accordance<br />

with the terms of the double taxation agreement between the UK and the<br />

country in which Toby is resident at the time, no income tax is deducted or<br />

due in respect of the £300,000 paid as flexible drawdown.<br />

Due to a change in his personal circumstances Toby has to return to the UK<br />

earlier than he had anticipated; he becomes UK resident once more for 2016-<br />

17 (UK part of split year commencing 2 September 2016). He therefore finds<br />

that he was temporarily non-resident under the statutory residence test.<br />

Under the relevant provisions the £300,000 taken as flexible drawdown is a<br />

‘relevant withdrawal’. As it was paid during Toby’s period of temporary nonresidence<br />

and was not charged to tax in the UK, the £300,000 is taxable as<br />

pension income as though it accrued in the period of Toby’s return to the UK<br />

rather than at the time it was received.<br />

Remitted foreign income<br />

6.16 Where you:<br />

<br />

<br />

use the remittance basis, and<br />

remit relevant foreign income to the UK during the period in which you<br />

are temporarily non-resident,<br />

RDR3 75