Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

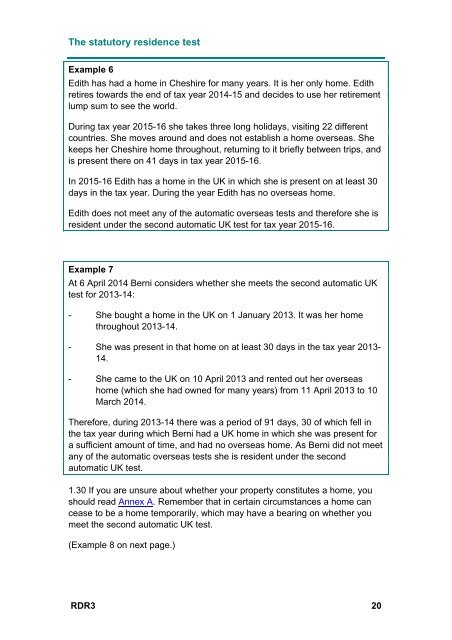

The statutory residence test<br />

Example 6<br />

Edith has had a home in Cheshire for many years. It is her only home. Edith<br />

retires towards the end of tax year 2014-15 and decides to use her retirement<br />

lump sum to see the world.<br />

During tax year 2015-16 she takes three long holidays, visiting 22 different<br />

countries. She moves around and does not establish a home overseas. She<br />

keeps her Cheshire home throughout, returning to it briefly between trips, and<br />

is present there on 41 days in tax year 2015-16.<br />

In 2015-16 Edith has a home in the UK in which she is present on at least 30<br />

days in the tax year. During the year Edith has no overseas home.<br />

Edith does not meet any of the automatic overseas tests and therefore she is<br />

resident under the second automatic UK test for tax year 2015-16.<br />

Example 7<br />

At 6 April 2014 Berni considers whether she meets the second automatic UK<br />

test for 2013-14:<br />

- She bought a home in the UK on 1 January 2013. It was her home<br />

throughout 2013-14.<br />

- She was present in that home on at least 30 days in the tax year 2013-<br />

14.<br />

- She came to the UK on 10 April 2013 and rented out her overseas<br />

home (which she had owned for many years) from 11 April 2013 to 10<br />

March 2014.<br />

Therefore, during 2013-14 there was a period of 91 days, 30 of which fell in<br />

the tax year during which Berni had a UK home in which she was present for<br />

a sufficient amount of time, and had no overseas home. As Berni did not meet<br />

any of the automatic overseas tests she is resident under the second<br />

automatic UK test.<br />

1.30 If you are unsure about whether your property constitutes a home, you<br />

should read Annex A. Remember that in certain circumstances a home can<br />

cease to be a home temporarily, which may have a bearing on whether you<br />

meet the second automatic UK test.<br />

(Example 8 on next page.)<br />

RDR3 20