Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

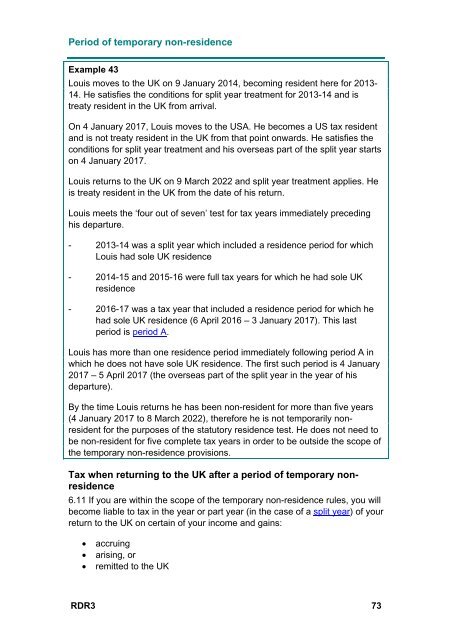

Period of temporary non-residence<br />

Example 43<br />

Louis moves to the UK on 9 January 2014, becoming resident here for 2013-<br />

14. He satisfies the conditions for split year treatment for 2013-14 and is<br />

treaty resident in the UK from arrival.<br />

On 4 January 2017, Louis moves to the USA. He becomes a US tax resident<br />

and is not treaty resident in the UK from that point onwards. He satisfies the<br />

conditions for split year treatment and his overseas part of the split year starts<br />

on 4 January 2017.<br />

Louis returns to the UK on 9 March 2022 and split year treatment applies. He<br />

is treaty resident in the UK from the date of his return.<br />

Louis meets the ‘four out of seven’ test for tax years immediately preceding<br />

his departure.<br />

- 2013-14 was a split year which included a residence period for which<br />

Louis had sole UK residence<br />

- 2014-15 and 2015-16 were full tax years for which he had sole UK<br />

residence<br />

- 2016-17 was a tax year that included a residence period for which he<br />

had sole UK residence (6 April 2016 – 3 January 2017). This last<br />

period is period A.<br />

Louis has more than one residence period immediately following period A in<br />

which he does not have sole UK residence. The first such period is 4 January<br />

2017 – 5 April 2017 (the overseas part of the split year in the year of his<br />

departure).<br />

By the time Louis returns he has been non-resident for more than five years<br />

(4 January 2017 to 8 March 2022), therefore he is not temporarily nonresident<br />

for the purposes of the statutory residence test. He does not need to<br />

be non-resident for five complete tax years in order to be outside the scope of<br />

the temporary non-residence provisions.<br />

Tax when returning to the UK after a period of temporary nonresidence<br />

6.11 If you are within the scope of the temporary non-residence rules, you will<br />

become liable to tax in the year or part year (in the case of a split year) of your<br />

return to the UK on certain of your income and gains:<br />

<br />

<br />

<br />

accruing<br />

arising, or<br />

remitted to the UK<br />

RDR3 73