Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

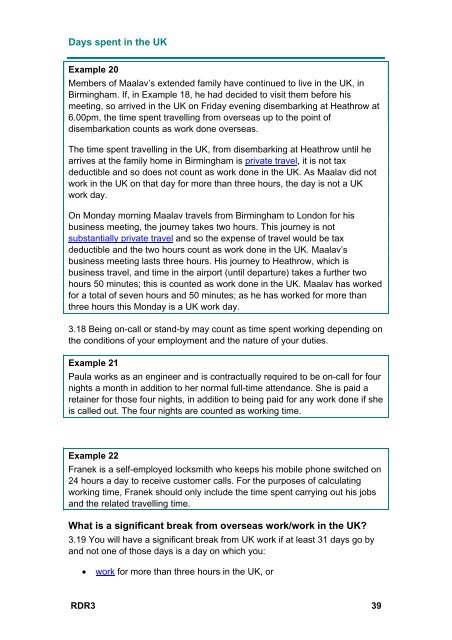

Days spent in the UK<br />

Example 20<br />

Members of Maalav’s extended family have continued to live in the UK, in<br />

Birmingham. If, in Example 18, he had decided to visit them before his<br />

meeting, so arrived in the UK on Friday evening disembarking at Heathrow at<br />

6.00pm, the time spent travelling from overseas up to the point of<br />

disembarkation counts as work done overseas.<br />

The time spent travelling in the UK, from disembarking at Heathrow until he<br />

arrives at the family home in Birmingham is private travel, it is not tax<br />

deductible and so does not count as work done in the UK. As Maalav did not<br />

work in the UK on that day for more than three hours, the day is not a UK<br />

work day.<br />

On Monday morning Maalav travels from Birmingham to London for his<br />

business meeting, the journey takes two hours. This journey is not<br />

substantially private travel and so the expense of travel would be tax<br />

deductible and the two hours count as work done in the UK. Maalav’s<br />

business meeting lasts three hours. His journey to Heathrow, which is<br />

business travel, and time in the airport (until departure) takes a further two<br />

hours 50 minutes; this is counted as work done in the UK. Maalav has worked<br />

for a total of seven hours and 50 minutes; as he has worked for more than<br />

three hours this Monday is a UK work day.<br />

3.18 Being on-call or stand-by may count as time spent working depending on<br />

the conditions of your employment and the nature of your duties.<br />

Example 21<br />

Paula works as an engineer and is contractually required to be on-call for four<br />

nights a month in addition to her normal full-time attendance. She is paid a<br />

retainer for those four nights, in addition to being paid for any work done if she<br />

is called out. The four nights are counted as working time.<br />

Example 22<br />

Franek is a self-employed locksmith who keeps his mobile phone switched on<br />

24 hours a day to receive customer calls. For the purposes of calculating<br />

working time, Franek should only include the time spent carrying out his jobs<br />

and the related travelling time.<br />

What is a significant break from overseas work/work in the UK?<br />

3.19 You will have a significant break from UK work if at least 31 days go by<br />

and not one of those days is a day on which you:<br />

<br />

work for more than three hours in the UK, or<br />

RDR3 39