Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

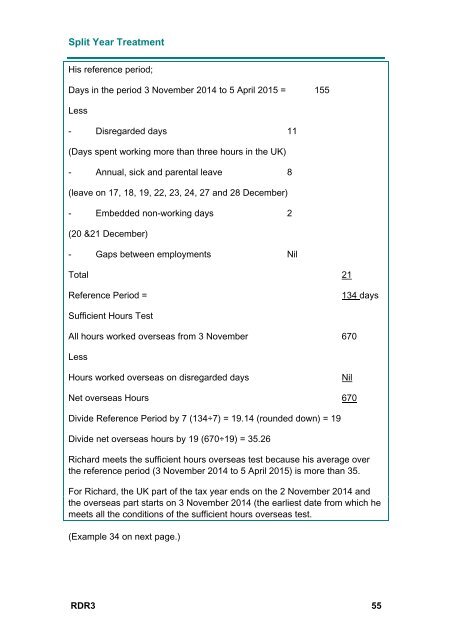

Split Year Treatment<br />

His reference period;<br />

Days in the period 3 November 2014 to 5 April 2015 = 155<br />

Less<br />

- Disregarded days 11<br />

(Days spent working more than three hours in the UK)<br />

- Annual, sick and parental leave 8<br />

(leave on 17, 18, 19, 22, 23, 24, 27 and 28 December)<br />

- Embedded non-working days 2<br />

(20 &21 December)<br />

- Gaps between employments Nil<br />

Total 21<br />

Reference Period =<br />

134 days<br />

Sufficient Hours <strong>Test</strong><br />

All hours worked overseas from 3 November 670<br />

Less<br />

Hours worked overseas on disregarded days<br />

Nil<br />

Net overseas Hours 670<br />

Divide Reference Period by 7 (134÷7) = 19.14 (rounded down) = 19<br />

Divide net overseas hours by 19 (670÷19) = 35.26<br />

Richard meets the sufficient hours overseas test because his average over<br />

the reference period (3 November 2014 to 5 April 2015) is more than 35.<br />

For Richard, the UK part of the tax year ends on the 2 November 2014 and<br />

the overseas part starts on 3 November 2014 (the earliest date from which he<br />

meets all the conditions of the sufficient hours overseas test.<br />

(Example 34 on next page.)<br />

RDR3 55