Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

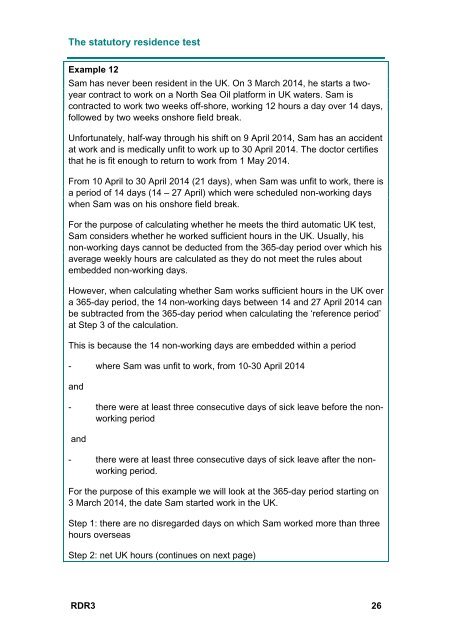

The statutory residence test<br />

Example 12<br />

Sam has never been resident in the UK. On 3 March 2014, he starts a twoyear<br />

contract to work on a North Sea Oil platform in UK waters. Sam is<br />

contracted to work two weeks off-shore, working 12 hours a day over 14 days,<br />

followed by two weeks onshore field break.<br />

Unfortunately, half-way through his shift on 9 April 2014, Sam has an accident<br />

at work and is medically unfit to work up to 30 April 2014. The doctor certifies<br />

that he is fit enough to return to work from 1 May 2014.<br />

From 10 April to 30 April 2014 (21 days), when Sam was unfit to work, there is<br />

a period of 14 days (14 – 27 April) which were scheduled non-working days<br />

when Sam was on his onshore field break.<br />

For the purpose of calculating whether he meets the third automatic UK test,<br />

Sam considers whether he worked sufficient hours in the UK. Usually, his<br />

non-working days cannot be deducted from the 365-day period over which his<br />

average weekly hours are calculated as they do not meet the rules about<br />

embedded non-working days.<br />

However, when calculating whether Sam works sufficient hours in the UK over<br />

a 365-day period, the 14 non-working days between 14 and 27 April 2014 can<br />

be subtracted from the 365-day period when calculating the ‘reference period’<br />

at Step 3 of the calculation.<br />

This is because the 14 non-working days are embedded within a period<br />

- where Sam was unfit to work, from 10-30 April 2014<br />

and<br />

- there were at least three consecutive days of sick leave before the nonworking<br />

period<br />

and<br />

- there were at least three consecutive days of sick leave after the nonworking<br />

period.<br />

For the purpose of this example we will look at the 365-day period starting on<br />

3 March 2014, the date Sam started work in the UK.<br />

Step 1: there are no disregarded days on which Sam worked more than three<br />

hours overseas<br />

Step 2: net UK hours (continues on next page)<br />

RDR3 26