Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

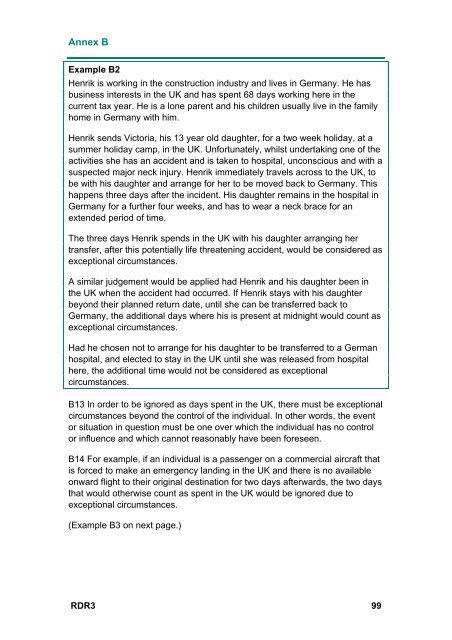

Annex B<br />

Example B2<br />

Henrik is working in the construction industry and lives in Germany. He has<br />

business interests in the UK and has spent 68 days working here in the<br />

current tax year. He is a lone parent and his children usually live in the family<br />

home in Germany with him.<br />

Henrik sends Victoria, his 13 year old daughter, for a two week holiday, at a<br />

summer holiday camp, in the UK. Unfortunately, whilst undertaking one of the<br />

activities she has an accident and is taken to hospital, unconscious and with a<br />

suspected major neck injury. Henrik immediately travels across to the UK, to<br />

be with his daughter and arrange for her to be moved back to Germany. This<br />

happens three days after the incident. His daughter remains in the hospital in<br />

Germany for a further four weeks, and has to wear a neck brace for an<br />

extended period of time.<br />

The three days Henrik spends in the UK with his daughter arranging her<br />

transfer, after this potentially life threatening accident, would be considered as<br />

exceptional circumstances.<br />

A similar judgement would be applied had Henrik and his daughter been in<br />

the UK when the accident had occurred. If Henrik stays with his daughter<br />

beyond their planned return date, until she can be transferred back to<br />

Germany, the additional days where his is present at midnight would count as<br />

exceptional circumstances.<br />

Had he chosen not to arrange for his daughter to be transferred to a German<br />

hospital, and elected to stay in the UK until she was released from hospital<br />

here, the additional time would not be considered as exceptional<br />

circumstances.<br />

B13 In order to be ignored as days spent in the UK, there must be exceptional<br />

circumstances beyond the control of the individual. In other words, the event<br />

or situation in question must be one over which the individual has no control<br />

or influence and which cannot reasonably have been foreseen.<br />

B14 For example, if an individual is a passenger on a commercial aircraft that<br />

is forced to make an emergency landing in the UK and there is no available<br />

onward flight to their original destination for two days afterwards, the two days<br />

that would otherwise count as spent in the UK would be ignored due to<br />

exceptional circumstances.<br />

(Example B3 on next page.)<br />

RDR3 99