Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

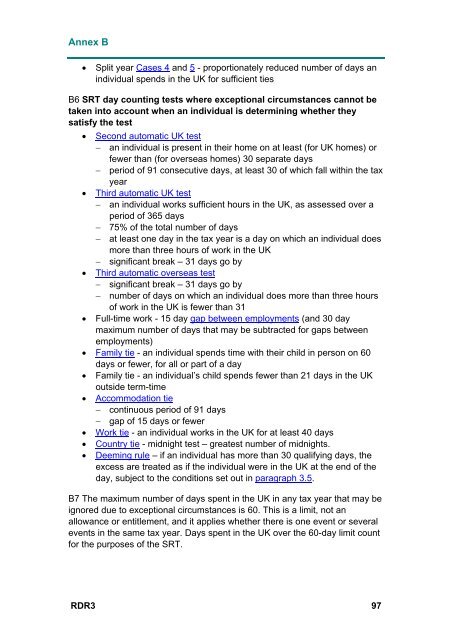

Annex B<br />

<br />

Split year Cases 4 and 5 - proportionately reduced number of days an<br />

individual spends in the UK for sufficient ties<br />

B6 SRT day counting tests where exceptional circumstances cannot be<br />

taken into account when an individual is determining whether they<br />

satisfy the test<br />

Second automatic UK test<br />

an individual is present in their home on at least (for UK homes) or<br />

fewer than (for overseas homes) 30 separate days<br />

period of 91 consecutive days, at least 30 of which fall within the tax<br />

year<br />

Third automatic UK test<br />

an individual works sufficient hours in the UK, as assessed over a<br />

period of 365 days<br />

75% of the total number of days<br />

at least one day in the tax year is a day on which an individual does<br />

more than three hours of work in the UK<br />

significant break – 31 days go by<br />

Third automatic overseas test<br />

significant break – 31 days go by<br />

number of days on which an individual does more than three hours<br />

of work in the UK is fewer than 31<br />

Full-time work - 15 day gap between employments (and 30 day<br />

maximum number of days that may be subtracted for gaps between<br />

employments)<br />

Family tie - an individual spends time with their child in person on 60<br />

days or fewer, for all or part of a day<br />

Family tie - an individual’s child spends fewer than 21 days in the UK<br />

outside term-time<br />

Accommodation tie<br />

continuous period of 91 days<br />

gap of 15 days or fewer<br />

Work tie - an individual works in the UK for at least 40 days<br />

<br />

<br />

Country tie - midnight test – greatest number of midnights.<br />

Deeming rule – if an individual has more than 30 qualifying days, the<br />

excess are treated as if the individual were in the UK at the end of the<br />

day, subject to the conditions set out in paragraph 3.5.<br />

B7 The maximum number of days spent in the UK in any tax year that may be<br />

ignored due to exceptional circumstances is 60. This is a limit, not an<br />

allowance or entitlement, and it applies whether there is one event or several<br />

events in the same tax year. Days spent in the UK over the 60-day limit count<br />

for the purposes of the SRT.<br />

RDR3 97