Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

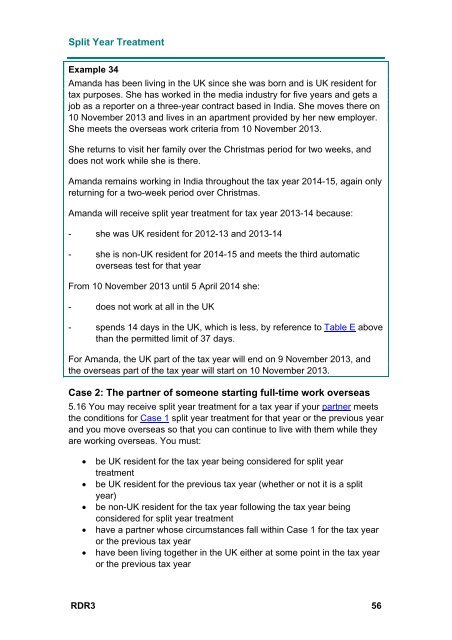

Split Year Treatment<br />

Example 34<br />

Amanda has been living in the UK since she was born and is UK resident for<br />

tax purposes. She has worked in the media industry for five years and gets a<br />

job as a reporter on a three-year contract based in India. She moves there on<br />

10 November 2013 and lives in an apartment provided by her new employer.<br />

She meets the overseas work criteria from 10 November 2013.<br />

She returns to visit her family over the Christmas period for two weeks, and<br />

does not work while she is there.<br />

Amanda remains working in India throughout the tax year 2014-15, again only<br />

returning for a two-week period over Christmas.<br />

Amanda will receive split year treatment for tax year 2013-14 because:<br />

- she was UK resident for 2012-13 and 2013-14<br />

- she is non-UK resident for 2014-15 and meets the third automatic<br />

overseas test for that year<br />

From 10 November 2013 until 5 April 2014 she:<br />

- does not work at all in the UK<br />

- spends 14 days in the UK, which is less, by reference to Table E above<br />

than the permitted limit of 37 days.<br />

For Amanda, the UK part of the tax year will end on 9 November 2013, and<br />

the overseas part of the tax year will start on 10 November 2013.<br />

Case 2: The partner of someone starting full-time work overseas<br />

5.16 You may receive split year treatment for a tax year if your partner meets<br />

the conditions for Case 1 split year treatment for that year or the previous year<br />

and you move overseas so that you can continue to live with them while they<br />

are working overseas. You must:<br />

<br />

<br />

<br />

<br />

<br />

be UK resident for the tax year being considered for split year<br />

treatment<br />

be UK resident for the previous tax year (whether or not it is a split<br />

year)<br />

be non-UK resident for the tax year following the tax year being<br />

considered for split year treatment<br />

have a partner whose circumstances fall within Case 1 for the tax year<br />

or the previous tax year<br />

have been living together in the UK either at some point in the tax year<br />

or the previous tax year<br />

RDR3 56