Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

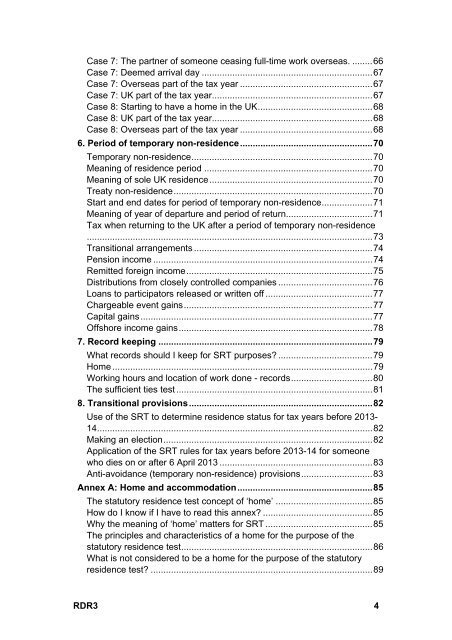

Case 7: The partner of someone ceasing full-time work overseas. ........66<br />

Case 7: Deemed arrival day ...................................................................67<br />

Case 7: Overseas part of the tax year ....................................................67<br />

Case 7: UK part of the tax year...............................................................67<br />

Case 8: Starting to have a home in the UK.............................................68<br />

Case 8: UK part of the tax year...............................................................68<br />

Case 8: Overseas part of the tax year ....................................................68<br />

6. Period of temporary non-residence....................................................70<br />

Temporary non-residence.......................................................................70<br />

Meaning of residence period ..................................................................70<br />

Meaning of sole UK residence................................................................70<br />

Treaty non-residence..............................................................................70<br />

Start and end dates for period of temporary non-residence....................71<br />

Meaning of year of departure and period of return..................................71<br />

Tax when returning to the UK after a period of temporary non-residence<br />

................................................................................................................73<br />

Transitional arrangements ......................................................................74<br />

Pension income ......................................................................................74<br />

Remitted foreign income.........................................................................75<br />

Distributions from closely controlled companies .....................................76<br />

Loans to participators released or written off ..........................................77<br />

Chargeable event gains..........................................................................77<br />

Capital gains...........................................................................................77<br />

Offshore income gains............................................................................78<br />

7. Record keeping ....................................................................................79<br />

What records should I keep for SRT purposes? .....................................79<br />

Home ......................................................................................................79<br />

Working hours and location of work done - records................................80<br />

The sufficient ties test .............................................................................81<br />

8. Transitional provisions........................................................................82<br />

Use of the SRT to determine residence status for tax years before 2013-<br />

14............................................................................................................82<br />

Making an election..................................................................................82<br />

Application of the SRT rules for tax years before 2013-14 for someone<br />

who dies on or after 6 April 2013 ............................................................83<br />

Anti-avoidance (temporary non-residence) provisions............................83<br />

Annex A: Home and accommodation.....................................................85<br />

The statutory residence test concept of ‘home’ ......................................85<br />

How do I know if I have to read this annex? ...........................................85<br />

Why the meaning of ‘home’ matters for SRT ..........................................85<br />

The principles and characteristics of a home for the purpose of the<br />

statutory residence test...........................................................................86<br />

What is not considered to be a home for the purpose of the statutory<br />

residence test? .......................................................................................89<br />

RDR3 4