Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

Statutory Residence Test - HM Revenue & Customs

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The statutory residence test<br />

for each gap, up to a maximum of 30 days in a tax year, or the modified<br />

amount in another relevant period (see Table E for split year Case 1 and<br />

Table G for split year Case 6).<br />

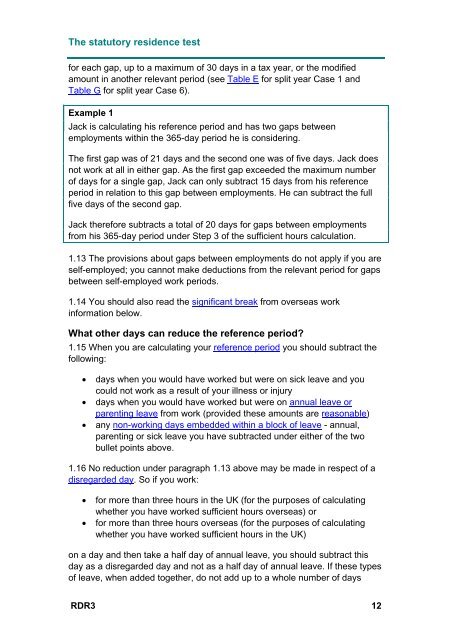

Example 1<br />

Jack is calculating his reference period and has two gaps between<br />

employments within the 365-day period he is considering.<br />

The first gap was of 21 days and the second one was of five days. Jack does<br />

not work at all in either gap. As the first gap exceeded the maximum number<br />

of days for a single gap, Jack can only subtract 15 days from his reference<br />

period in relation to this gap between employments. He can subtract the full<br />

five days of the second gap.<br />

Jack therefore subtracts a total of 20 days for gaps between employments<br />

from his 365-day period under Step 3 of the sufficient hours calculation.<br />

1.13 The provisions about gaps between employments do not apply if you are<br />

self-employed; you cannot make deductions from the relevant period for gaps<br />

between self-employed work periods.<br />

1.14 You should also read the significant break from overseas work<br />

information below.<br />

What other days can reduce the reference period?<br />

1.15 When you are calculating your reference period you should subtract the<br />

following:<br />

<br />

<br />

<br />

days when you would have worked but were on sick leave and you<br />

could not work as a result of your illness or injury<br />

days when you would have worked but were on annual leave or<br />

parenting leave from work (provided these amounts are reasonable)<br />

any non-working days embedded within a block of leave - annual,<br />

parenting or sick leave you have subtracted under either of the two<br />

bullet points above.<br />

1.16 No reduction under paragraph 1.13 above may be made in respect of a<br />

disregarded day. So if you work:<br />

<br />

<br />

for more than three hours in the UK (for the purposes of calculating<br />

whether you have worked sufficient hours overseas) or<br />

for more than three hours overseas (for the purposes of calculating<br />

whether you have worked sufficient hours in the UK)<br />

on a day and then take a half day of annual leave, you should subtract this<br />

day as a disregarded day and not as a half day of annual leave. If these types<br />

of leave, when added together, do not add up to a whole number of days<br />

RDR3 12