Annual Report 2008 - Ministry of Finance and Planning

Annual Report 2008 - Ministry of Finance and Planning

Annual Report 2008 - Ministry of Finance and Planning

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

1. Macro Economic Perspectives<br />

21<br />

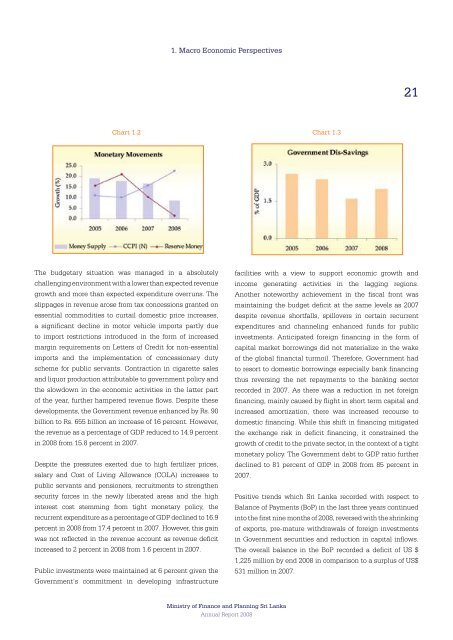

Chart 1.2 Chart 1.3<br />

The budgetary situation was managed in a absolutely<br />

challenging environment with a lower than expected revenue<br />

growth <strong>and</strong> more than expected expenditure overruns. The<br />

slippages in revenue arose from tax concessions granted on<br />

essential commodities to curtail domestic price increases,<br />

a significant decline in motor vehicle imports partly due<br />

to import restrictions introduced in the form <strong>of</strong> increased<br />

margin requirements on Letters <strong>of</strong> Credit for non-essential<br />

imports <strong>and</strong> the implementation <strong>of</strong> concessionary duty<br />

scheme for public servants. Contraction in cigarette sales<br />

<strong>and</strong> liquor production attributable to government policy <strong>and</strong><br />

the slowdown in the economic activities in the latter part<br />

<strong>of</strong> the year, further hampered revenue flows. Despite these<br />

developments, the Government revenue enhanced by Rs. 90<br />

billion to Rs. 655 billion an increase <strong>of</strong> 16 percent. However,<br />

the revenue as a percentage <strong>of</strong> GDP reduced to 14.9 percent<br />

in <strong>2008</strong> from 15.8 percent in 2007.<br />

Despite the pressures exerted due to high fertilizer prices,<br />

salary <strong>and</strong> Cost <strong>of</strong> Living Allowance (COLA) increases to<br />

public servants <strong>and</strong> pensioners, recruitments to strengthen<br />

security forces in the newly liberated areas <strong>and</strong> the high<br />

interest cost stemming from tight monetary policy, the<br />

recurrent expenditure as a percentage <strong>of</strong> GDP declined to 16.9<br />

percent in <strong>2008</strong> from 17.4 percent in 2007. However, this gain<br />

was not reflected in the revenue account as revenue deficit<br />

increased to 2 percent in <strong>2008</strong> from 1.6 percent in 2007.<br />

Public investments were maintained at 6 percent given the<br />

Government’s commitment in developing infrastructure<br />

facilities with a view to support economic growth <strong>and</strong><br />

income generating activities in the lagging regions.<br />

Another noteworthy achievement in the fiscal front was<br />

maintaining the budget deficit at the same levels as 2007<br />

despite revenue shortfalls, spillovers in certain recurrent<br />

expenditures <strong>and</strong> channeling enhanced funds for public<br />

investments. Anticipated foreign financing in the form <strong>of</strong><br />

capital market borrowings did not materialize in the wake<br />

<strong>of</strong> the global financial turmoil. Therefore, Government had<br />

to resort to domestic borrowings especially bank financing<br />

thus reversing the net repayments to the banking sector<br />

recorded in 2007. As there was a reduction in net foreign<br />

financing, mainly caused by flight in short term capital <strong>and</strong><br />

increased amortization, there was increased recourse to<br />

domestic financing. While this shift in financing mitigated<br />

the exchange risk in deficit financing, it constrained the<br />

growth <strong>of</strong> credit to the private sector, in the context <strong>of</strong> a tight<br />

monetary policy. The Government debt to GDP ratio further<br />

declined to 81 percent <strong>of</strong> GDP in <strong>2008</strong> from 85 percent in<br />

2007.<br />

Positive trends which Sri Lanka recorded with respect to<br />

Balance <strong>of</strong> Payments (BoP) in the last three years continued<br />

into the first nine months <strong>of</strong> <strong>2008</strong>, reversed with the shrinking<br />

<strong>of</strong> exports, pre-mature withdrawals <strong>of</strong> foreign investments<br />

in Government securities <strong>and</strong> reduction in capital inflows.<br />

The overall balance in the BoP recorded a deficit <strong>of</strong> US $<br />

1,225 million by end <strong>2008</strong> in comparison to a surplus <strong>of</strong> US$<br />

531 million in 2007.<br />

<strong>Ministry</strong> <strong>of</strong> <strong>Finance</strong> <strong>and</strong> <strong>Planning</strong> Sri Lanka<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>