English - DFDS

English - DFDS

English - DFDS

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

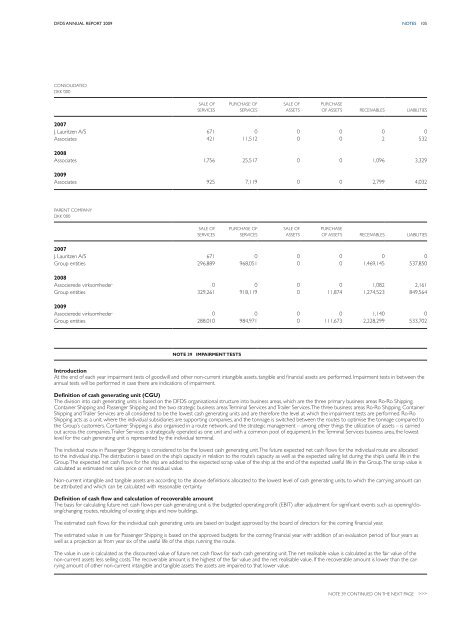

<strong>DFDS</strong> annual report 2009 NOTEs 105<br />

Consolidated<br />

DKK ‘000<br />

SALE OF<br />

SERVICES<br />

PURCHASE OF<br />

SERVICES<br />

SALE OF<br />

ASSETS<br />

PURCHASE<br />

OF ASSETS RECEIVABLES LIABILITIES<br />

2007<br />

J. Lauritzen A/S 671 0 0 0 0 0<br />

Associates 421 11,512 0 0 2 532<br />

2008<br />

Associates 1,756 25,517 0 0 1,096 3,329<br />

2009<br />

Associates 925 7,119 0 0 2,799 4,032<br />

Parent Company<br />

DKK ‘000<br />

SALE OF<br />

SERVICES<br />

PURCHASE OF<br />

SERVICES<br />

SALE OF<br />

ASSETS<br />

PURCHASE<br />

OF ASSETS RECEIVABLES LIABILITIES<br />

2007<br />

J. Lauritzen A/S 671 0 0 0 0 0<br />

Group entities 296,889 968,051 0 0 1,469,145 537,850<br />

2008<br />

Associerede virksomheder 0 0 0 0 1,082 2,161<br />

Group entities 329,261 918,119 0 11,874 1,274,523 849,564<br />

2009<br />

Associerede virksomheder 0 0 0 0 1,140 0<br />

Group entities 288,010 984,971 0 111,673 2,228,299 533,702<br />

Note 39 Impairment tests<br />

Introduction<br />

At the end of each year impairment tests of goodwill and other non-current intangible assets, tangible and financial assets are performed. Impairment tests in between the<br />

annual tests will be performed in case there are indications of impairment.<br />

Definition of cash generating unit (CGU)<br />

The division into cash generating units is based on the <strong>DFDS</strong> organisational structure into business areas, which are the three primary business areas Ro-Ro Shipping,<br />

Container Shipping and Passenger Shipping and the two strategic business areas Terminal Services and Trailer Services. The three business areas Ro-Ro Shipping, Container<br />

Shipping and Trailer Services are all considered to be the lowest cash generating units and are therefore the level at which the impairment tests are performed. Ro-Ro<br />

Shipping acts as a unit, where the individual subsidiaries are supporting companies, and the tonnage is switched between the routes to optimise the tonnage compared to<br />

the Group’s customers. Container Shipping is also organised in a route network, and the strategic management – among other things the utilization of assets – is carried<br />

out across the companies. Trailer Services is strategically operated as one unit and with a common pool of equipment. In the Terminal Services business area, the lowest<br />

level for the cash generating unit is represented by the individual terminal.<br />

The individual route in Passenger Shipping is considered to be the lowest cash generating unit. The future expected net cash flows for the individual route are allocated<br />

to the individual ship. The distribution is based on the ship’s capacity in relation to the route’s capacity as well as the expected sailing list during the ship’s useful life in the<br />

Group. The expected net cash flows for the ship are added to the expected scrap value of the ship at the end of the expected useful life in the Group. The scrap value is<br />

calculated as estimated net sales price or net residual value.<br />

Non-current intangible and tangible assets are according to the above definitions allocated to the lowest level of cash generating units, to which the carrying amount can<br />

be attributed and which can be calculated with reasonable certainty.<br />

Definition of cash flow and calculation of recoverable amount<br />

The basis for calculating future net cash flows per cash generating unit is the budgeted operating profit (EBIT) after adjustment for significant events such as opening/closing/changing<br />

routes, rebuilding of existing ships and new buildings.<br />

The estimated cash flows for the individual cash generating units are based on budget approved by the board of directors for the coming financial year.<br />

The estimated value in use for Passenger Shipping is based on the approved budgets for the coming financial year with addition of an evaluation period of four years as<br />

well as a projection as from year six of the useful life of the ships running the route.<br />

The value in use is calculated as the discounted value of future net cash flows for each cash generating unit. The net realisable value is calculated as the fair value of the<br />

non-current assets less selling costs. The recoverable amount is the highest of the fair value and the net realisable value. If the recoverable amount is lower than the carrying<br />

amount of other non-current intangible and tangible assets the assets are impaired to that lower value.<br />

Note 39 continued on the next page >>>