English - DFDS

English - DFDS

English - DFDS

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>DFDS</strong> annual report 2009 Management Report 11<br />

When the transaction was announced it was contingent on a condition<br />

concerning approval by <strong>DFDS</strong>’ extraordinary general meeting<br />

to approve the rights issue and the directed rights issue. Both issues<br />

were approved at the extraordinary general meeting held on 11<br />

January 2010.<br />

Strategy follow-up<br />

The expected acquisition of Norfolkline represents the initial culmination<br />

of <strong>DFDS</strong>’ network strategy, which was drawn up in 2007 and based<br />

on a vision of creating a European, sea-based transport network. The<br />

strategy and its objectives are described in greater detail on page 8-9.<br />

Strategically, 2010 and 2011 is expected to be dominated by two<br />

main objectives: integrating <strong>DFDS</strong> and Norfolkline, and improving<br />

ROIC in <strong>DFDS</strong>’ existing activities.<br />

As announced at the time of the acquisition, integration of the<br />

two companies is expected to last two to three years. However,<br />

most of the process will be completed in the first two years. During<br />

this period, <strong>DFDS</strong>’ resources will primarily be focused on integration,<br />

so no major acquisitions or investments are expected in this period.<br />

However, opportunities to pursue acquisitions arise continuously, and<br />

smaller acquisitions that underpin the network strategy cannot be<br />

ruled out.<br />

The second main strategic objective relates to achieving a higher<br />

ROIC from existing activities. This is dependent partly on implementation<br />

of structural changes to activities, as well as ongoing operational<br />

changes and improvement in the difficult market conditions caused by<br />

the recession.<br />

<strong>DFDS</strong> implemented a streamlining process in 2008 and 2009, as<br />

outlined below, and Ro-Ro Shipping’s tonnage has been modernised. A<br />

recovery in the freight market and subsequent higher volumes are not<br />

expected to result in a need for new tonnage in 2010 or 2011.<br />

It is foreseen that the planned integration of Norfolkline will help<br />

to solve structural earnings problems on routes in the southern part<br />

of the North Sea. In addition, there is also a need to restructure certain<br />

routes in the Baltic Sea and phase out excess tonnage.<br />

A more focused financial control process was initiated at the end<br />

of 2009 with the aim of intensifying focus on areas of activity with low<br />

earnings. This process is expected to help improve operations in all<br />

business areas.<br />

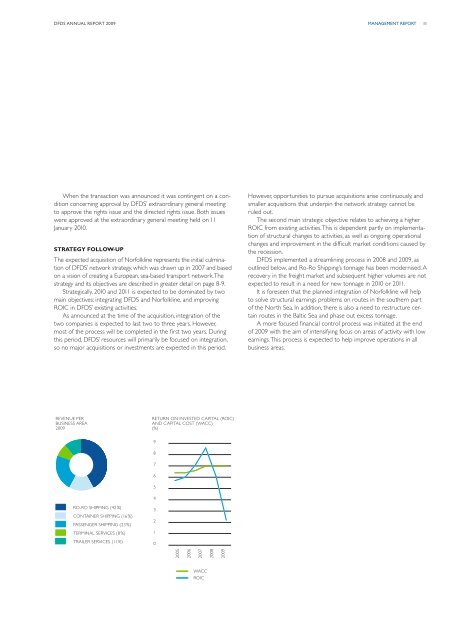

REVENUE PER<br />

BUSINESS AREA<br />

2009<br />

RETURN ON INVESTED CAPITAL (ROIC)<br />

AND CAPITAL COST (WACC)<br />

(%)<br />

9<br />

8<br />

7<br />

6<br />

5<br />

4<br />

RO-RO SHIPPING (42 %)<br />

CONTAINER SHIPPING (16 %)<br />

PASSENGER SHIPPING (23 %)<br />

TERMINAL SERVICES (8 %)<br />

TRAILER SERVICES (11 %)<br />

3<br />

2<br />

1<br />

0<br />

2005<br />

2006<br />

2007<br />

2008<br />

2009<br />

WACC<br />

ROIC