English - DFDS

English - DFDS

English - DFDS

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

38 Trailer services<br />

<strong>DFDS</strong> annual report 2009<br />

Markets, activities and customers<br />

Trailer Services provides door-door transport solutions of which<br />

the majority utilises <strong>DFDS</strong>’ route network in order to contribute<br />

to the network’s capacity utilisation. The primary market area<br />

is Northern Europe.<br />

The most important customer groups consist of importers and<br />

exporters of consumer goods, as well as manufacturers of heavy<br />

industrial goods, especially the automobile industry, whose logistics<br />

requirements include a significant element of transport by sea.<br />

Market trends<br />

Like the Group’s other freight-based business areas, the market<br />

trend for the door-door segment was characterised by a declining<br />

level of activity.<br />

Traffic between Sweden and the Continent was affected by<br />

reduced demand from the automobile industry, while traffic between<br />

Scandinavia and the UK experienced a shift in balance that resulted<br />

in increased equipment and positioning costs. Overcapacity on the<br />

market led to falling demand and greater price competition.<br />

In general, no significant changes in demand are expected in<br />

2010, but some growth is envisaged in markets where <strong>DFDS</strong>’ current<br />

market share is marginal. The primary focus will continue to be on<br />

improving profit margins through increased productivity and sales.<br />

Trailer success criteria<br />

The most important success criteria for Trailer Services are reliability<br />

of capacity, and delivery based on competitive cost levels. It is also important<br />

that combined trailer solutions, which utilise both rail and sea,<br />

provide a more environmentally positive alternative to road transport.<br />

Integration of the business area<br />

<strong>DFDS</strong>’ door-door IT system was installed in Sweden and Norway<br />

in January 2009. By mid-2010, all trailer companies in the business<br />

unit are expected to operate on the same IT platform. This<br />

will increase the possibilities for co-ordinating sales resources and<br />

optimising traffic, and will improve utilisation of the established joint<br />

trailer pool. It will also provide opportunities to further streamline<br />

administrative processes.<br />

In 2009, management of the Dutch subsidiary of SpeedCargo was<br />

merged with <strong>DFDS</strong> Container Line. Likewise, management has now<br />

been integrated in Norway, Belgium, the UK and Ireland.<br />

In order to strengthen the overall network and increase geographical<br />

coverage, integration of subsidiaries in the business unit will continue<br />

in 2010. Another important objective of the integration process<br />

is to continue to strengthen the basis for offering network solutions<br />

that incorporate multiple parts of <strong>DFDS</strong>’ route network.<br />

Activity DEVELOPMENT<br />

Despite difficult market conditions and lower level of activity, financial<br />

performance improved in 2009. This can largely be attributed to the<br />

activities of the Belgian company Halléns and SpeedCargo’s activities<br />

in the UK and Germany. Traffic was reduced between the UK and<br />

Scandinavia, mostly as a result of major imbalances in the flows of<br />

goods. The management of the Swedish SpeedCargo subsidiary was<br />

replaced in May 2009.<br />

Merging administrative tasks with similar functions in Container Shipping’s<br />

offices led to more efficient overall financial management. The falling<br />

level of activity also necessitated adaptation of the organisation, with<br />

an 8 % reduction in the number of staff. The efficiency drive will continue<br />

as all the companies in the business unit become increasingly closely<br />

integrated, e.g. following implementation of the joint IT system.<br />

Halléns’ traffic between Sweden and the Continent decreased<br />

significantly as a result of lower production in the automobile industry.<br />

Changes in the balance of traffic between Finland, Sweden and Denmark<br />

resulted in greater unused capacity and increased haulage costs.<br />

Halléns established a new trailer traffic between the Nordic Region<br />

and the Continent/Spain, based on ro-ro routes between Zeebrugge<br />

and Bilbao/Santander.<br />

In December 2009, the German SpeedCargo subsidiary reached<br />

agreement with the German transport and logistics company Schnellecke<br />

to take over trailer activities between North Germany and the UK.<br />

These activities make extensive use of <strong>DFDS</strong>’ ro-ro route between Cuxhaven<br />

and Immingham, which is an integral part of the transport chain.<br />

At the end of 2009, the trailer fleet comprised 1,400 units, of<br />

which approximately one third were owned compared to two-thirds<br />

previously. Overall, the trailer fleet has been reduced by 500 units,<br />

notwithstanding the addition of 300 mega-trailers. The share of inhouse<br />

haulage was also reduced on the Continent in order to achieve<br />

greater flexibility and lower costs.<br />

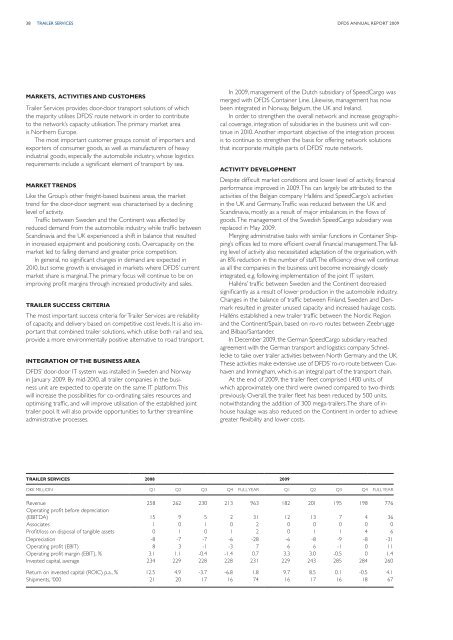

Trailer Services 2008 2009<br />

DKK miLLION Q1 Q2 Q3 Q4 FULL YEAR Q1 Q2 Q3 Q4 FULL YEAR<br />

Revenue 258 262 230 213 963 182 201 195 198 776<br />

Operating profit before depreciation<br />

(EBITDA) 15 9 5 2 31 12 13 7 4 36<br />

Associates 1 0 1 0 2 0 0 0 0 0<br />

Profit/loss on disposal of tangible assets 0 1 0 1 2 0 1 1 4 6<br />

Depreciation -8 -7 -7 -6 -28 -6 -8 -9 -8 -31<br />

Operating profit (EBIT) 8 3 -1 -3 7 6 6 -1 0 11<br />

Operating profit margin (EBIT), % 3.1 1.1 -0.4 -1.4 0.7 3.3 3.0 -0.5 0 1.4<br />

Invested capital, average 234 229 228 228 231 229 243 285 284 260<br />

Return on invested capital (ROIC) p.a., % 12.5 4.9 -3.7 -6.8 1.8 9.7 8.5 0.1 -0.5 4.1<br />

Shipments, '000 21 20 17 16 74 16 17 16 18 67