English - DFDS

English - DFDS

English - DFDS

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

66 NOTEs<br />

<strong>DFDS</strong> annual report 2009<br />

Assets<br />

Current assets are defined as:<br />

n Assets expected to be realised in, or are held for sale or consumption in,<br />

the normal course of <strong>DFDS</strong>’ operating cycle, or<br />

n Assets held primarily for trading purposes or which are expected to<br />

be realised within twelve months of the balance sheet date, or<br />

n Cash or cash equivalent assets that are not restricted in use.<br />

All other assets are defined as non-current assets.<br />

Non-current intangible and tangible assets<br />

Generally the following applies unless otherwise specified:<br />

n Non-current intangible and tangible assets are measured at cost less the<br />

accumulated amortisation/depreciation and impairment.<br />

n Cost for non-current intangible and tangible assets include the costs of<br />

external suppliers, materials and components (only tangible assets), direct<br />

wages and salaries.<br />

n Interest paid from the time of payment until the date when the asset is<br />

available for use is included in cost. Cost also comprises gains and losses on<br />

transactions designated as hedges of non-current tangible assets.<br />

n The basis for amortisation/depreciation is determined as the cost less the<br />

expected residual value.<br />

n Non-current intangible and tangible assets are amortised/depreciated on a<br />

straight-line basis to the estimated residual value over the expected useful<br />

life at <strong>DFDS</strong>.<br />

n Expected useful life at <strong>DFDS</strong> and residual value are reassessed at least<br />

once a year. In estimating the expected useful life for ships it is taken into<br />

consideration that <strong>DFDS</strong> is continuously spending substantial funds on<br />

ongoing maintenance.<br />

n The effect of changes to the amortisation/depreciation period or residual<br />

value is recognised prospectively as a change in the accounting estimate.<br />

Goodwill<br />

At initial recognition goodwill is recognised in the balance sheet at cost as<br />

described in the section ‘Business combinations’. Subsequently, goodwill is<br />

measured at cost less accumulated impairments. Goodwill is not amortised.<br />

An impairment test is performed annually in connection with the presentation<br />

of next year’s budget.<br />

The book value of goodwill is allocated to the Group’s cash-generating<br />

units at the time of acquisition. Allocation of goodwill to cash-generating units<br />

is described in Note 11 and 39.<br />

Development projects<br />

Development projects, primarily the development of IT software, are recognised<br />

as non-current intangible assets if the following criteria are met:<br />

n the projects are clearly defined and identifiable;<br />

n the Group intends to use the projects;<br />

n there is sufficient assurance that future earnings can cover<br />

development costs and administrative expenses; and<br />

n the cost can be reliably measured.<br />

Ships<br />

The rebuilding of ships is capitalised if the rebuilding can be attributed to:<br />

n Safety measures.<br />

n Measures to lengthen the useful life of the ship.<br />

n Measures to improve earnings.<br />

n Docking.<br />

Expenses for improvements and maintenance are recognised in the income<br />

statement as incurred, including general maintenance work, to the extent the<br />

work can be designated as ongoing general maintenance (day-to-day service).<br />

Basically, other costs are capitalised.<br />

Docking costs are capitalised and depreciated on a straight-line basis over<br />

the period between two dockings. In most cases, the docking interval is two<br />

years for passenger ships and 2½ years for freighters and ro-pax ships.<br />

Gains or losses on the disposal of ships are determined as the difference<br />

between the selling price less the selling costs and the carrying amount at the<br />

disposal date. Gains or losses on the disposal of ships are recognised as gain/<br />

loss on disposal of ships, buildings and terminals.<br />

Passenger and ro-pax ships<br />

Due to differences in the wear of the components of passenger and ro-pax<br />

ships, the cost of these ships is divided into components with low wear, such<br />

as hulls and engines, and components with high wear, such as parts of the<br />

hotel and catering area.<br />

Freighters<br />

Cost of freighters is not divided into components as there is no difference in<br />

the wear of these ships.<br />

Depreciation, expected useful life and residual value<br />

The average depreciation period for component with low wear is 30 years<br />

for passenger ships and 25 years for ro-pax ships from the year in which the<br />

ships were built. The depreciation period for freighters is 25 years from the<br />

year in which the ships were built.<br />

For passenger and ro-pax ships, components with high wear are depreciated<br />

over 10-15 years. For ships the residual value of components with high<br />

wear is determined as DKK 0.<br />

Other non-current tangible assets<br />

Other non-current tangible assets comprise buildings, terminals and machinery,<br />

tools and equipment and leasehold improvements.<br />

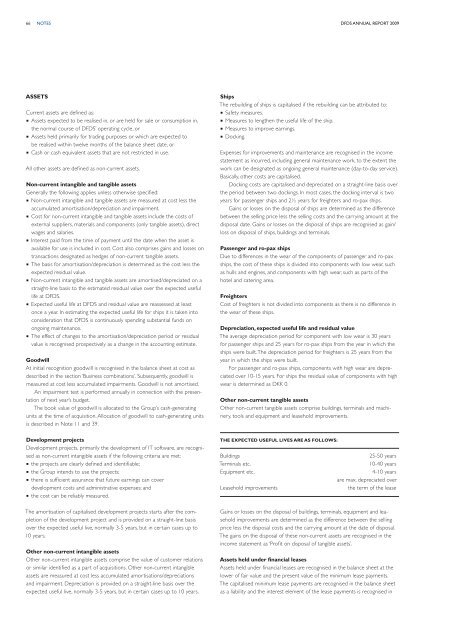

The expected useful lives are as follows:<br />

Buildings<br />

Terminals etc.<br />

Equipment etc.<br />

Leasehold improvements<br />

25-50 years<br />

10-40 years<br />

4-10 years<br />

are max. depreciated over<br />

the term of the lease<br />

The amortisation of capitalised development projects starts after the completion<br />

of the development project and is provided on a straight-line basis<br />

over the expected useful live, normally 3-5 years, but in certain cases up to<br />

10 years.<br />

Other non-current intangible assets<br />

Other non-current intangible assets comprise the value of customer relations<br />

or similar identified as a part of acquisitions. Other non-current intangible<br />

assets are measured at cost less accumulated amortisations/depreciations<br />

and impairment. Depreciation is provided on a straight-line basis over the<br />

expected useful live, normally 3-5 years, but in certain cases up to 10 years.<br />

Gains or losses on the disposal of buildings, terminals, equipment and leasehold<br />

improvements are determined as the difference between the selling<br />

price less the disposal costs and the carrying amount at the date of disposal.<br />

The gains on the disposal of these non-current assets are recognised in the<br />

income statement as ‘Profit on disposal of tangible assets’.<br />

Assets held under financial leases<br />

Assets held under financial leases are recognised in the balance sheet at the<br />

lower of fair value and the present value of the minimum lease payments.<br />

The capitalised minimum lease payments are recognised in the balance sheet<br />

as a liability and the interest element of the lease payments is recognised in