English - DFDS

English - DFDS

English - DFDS

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>DFDS</strong> annual report 2009 NOTEs 85<br />

>>> Note 19 continued<br />

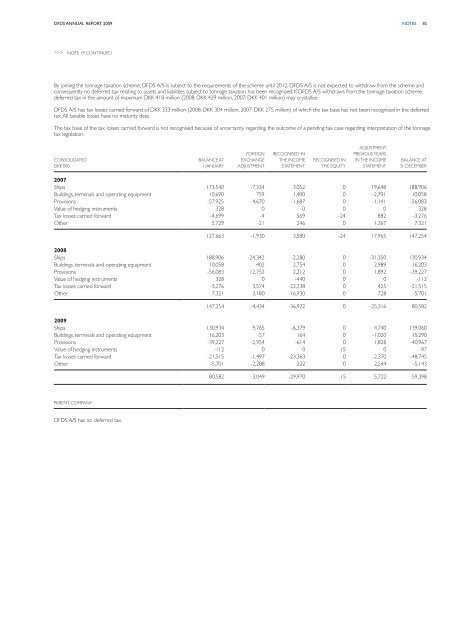

By joining the tonnage taxation scheme, <strong>DFDS</strong> A/S is subject to the requirements of the scheme until 2012. <strong>DFDS</strong> A/S is not expected to withdraw from the scheme and<br />

consequently no deferred tax relating to assets and liabilities subject to tonnage taxation has been recognised. If <strong>DFDS</strong> A/S withdraws from the tonnage taxation scheme,<br />

deferred tax in the amount of maximum DKK 418 million (2008: DKK 429 million, 2007: DKK 401 million) may crystallise.<br />

<strong>DFDS</strong> A/S has tax losses carried forward of DKK 333 million (2008: DKK 304 million, 2007: DKK 275 million) of which the tax base has not been recognised in the deferred<br />

tax. All taxable losses have no maturity date.<br />

The tax base of the tax losses carried forward is not recognised because of uncertainty regarding the outcome of a pending tax case regarding interpretation of the tonnage<br />

tax legislation.<br />

Consolidated<br />

DKK’000<br />

BALANCE AT<br />

1 JANUARY<br />

FOREIGN<br />

EXCHANGE<br />

ADJUSTMENT<br />

RECOGNISED IN<br />

THE INCOME<br />

STATEMENT<br />

RECOGNISED IN<br />

THE EQUITY<br />

ADJUSTMENT,<br />

PREVIOUS YEARS<br />

IN THE INCOME<br />

STATEMENT<br />

BALANCE AT<br />

31 DECEMBER<br />

2007<br />

Ships 173,540 -7,334 3,052 0 19,648 188,906<br />

Buildings, terminals and operating equipment 10,690 759 1,400 0 -2,791 10,058<br />

Provisions -57,925 4,670 -1,687 0 -1,141 -56,083<br />

Value of hedging instruments 328 0 0 0 0 328<br />

Tax losses carried forward -4,699 -4 569 -24 882 -3,276<br />

Other 5,729 -21 246 0 1,367 7,321<br />

127,663 -1,930 3,580 -24 17,965 147,254<br />

2008<br />

Ships 188,906 -24,342 -2,280 0 -31,350 130,934<br />

Buildings, terminals and operating equipment 10,058 402 2,754 0 2,989 16,203<br />

Provisions -56,083 12,752 2,212 0 1,892 -39,227<br />

Value of hedging instruments 328 0 -440 0 0 -112<br />

Tax losses carried forward -3,276 3,574 -22,238 0 425 -21,515<br />

Other 7,321 3,180 -16,930 0 728 -5,701<br />

147,254 -4,434 -36,922 0 -25,316 80,582<br />

2009<br />

Ships 130,934 9,765 -6,379 0 4,740 139,060<br />

Buildings, terminals and operating equipment 16,203 -57 164 0 -1,020 15,290<br />

Provisions -39,227 -2,954 -614 0 1,828 -40,967<br />

Value of hedging instruments -112 0 0 15 0 -97<br />

Tax losses carried forward -21,515 -1,497 -23,363 0 -2,370 -48,745<br />

Other -5,701 -2,208 222 0 2,544 -5,143<br />

80,582 3,049 -29,970 15 5,722 59,398<br />

Parent Company<br />

<strong>DFDS</strong> A/S has no deferred tax.