English - DFDS

English - DFDS

English - DFDS

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>DFDS</strong> annual report 2009 container shipping 27<br />

15 million. This, combined with greater efficiency in production, is<br />

expected to contribute to improved financial performance in 2010.<br />

<strong>DFDS</strong> Suardiaz Line (50/50 joint venture with Logistica Suardiaz,<br />

Bilbao) operates container traffic between Spain and Britain’s west<br />

coast and Ireland. Financial performance improved in 2009 as a result<br />

of adjusting costs to meet changing market conditions, including lower<br />

tonnage costs, and this trend is expected to continue in 2010.<br />

Shipping Logistics: Activity levels and the result for industrial logistics<br />

activities in Norway and Sweden fell significantly in 2009 due to lower<br />

volumes from the paper industry. As a consequence, the route between<br />

Norway/Sweden and Ireland was closed in October 2009 and<br />

volumes transferred to Ro-Ro Shipping’s route between Gothenburg<br />

and Immingham. Closing the Ireland route triggered costs for closing<br />

the office in Lysekil.<br />

As a result of the above route closure and the changed market<br />

conditions in general, the number of sideport ships was reduced from<br />

seven to five. The return of two ships in 2009 triggered a one-off cost<br />

of DKK 12 million. In close collaboration with industrial clients, the<br />

route network was reorganised in early 2010, resulting in an integrated<br />

sailing schedule for the three largest sideport/container ships<br />

on routes between Scandinavia and the Continent, the UK and Spain.<br />

This is expected to provide opportunities for higher volumes and<br />

more efficient fleet utilisation. Furthermore, a small container ship has<br />

been deployed between Western Norway and Rotterdam to service<br />

volumes from the paper industry.<br />

Chartering: Activities include the operation of small tramp ships in<br />

Europe and the Mediterranean, based on fixed contracts e.g. with<br />

Norwegian industrial customers. Demand fell by approximately 50 %<br />

in 2009, which resulted in a significant deficit compared to the satisfactory<br />

earnings in 2008. In 2009, the fleet was reduced from nine to five<br />

ships. Three of these ships will be chartered at rates significantly higher<br />

than current market levels until the end of 2010. Financial performance<br />

will therefore improve in 2010, but not expected to return to<br />

a satisfactory level until 2011.<br />

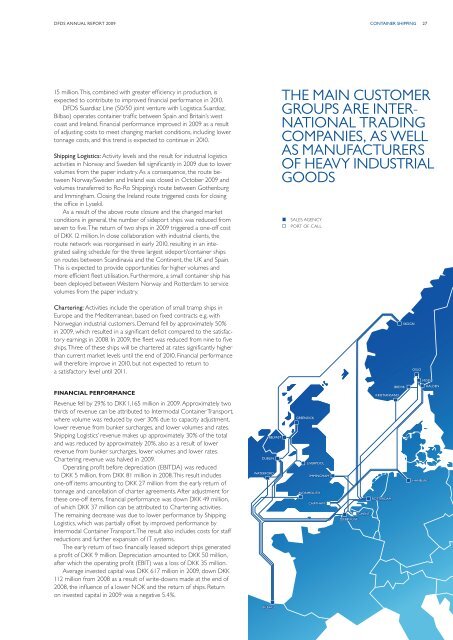

The main customer<br />

groups ARE International<br />

trading<br />

companies, as well<br />

as manu FActurers<br />

of heavy industrial<br />

goods<br />

SALES AGENCY<br />

PORT OF CALL<br />

SKOGN<br />

OSLO<br />

Financial performance<br />

Revenue fell by 29 % to DKK 1,165 million in 2009. Approximately two<br />

thirds of revenue can be attributed to Intermodal Container Transport,<br />

where volume was reduced by over 30 % due to capacity adjustment,<br />

lower revenue from bunker surcharges, and lower volumes and rates.<br />

Shipping Logistics’ revenue makes up approximately 30 % of the total<br />

and was reduced by approximately 20 %, also as a result of lower<br />

revenue from bunker surcharges, lower volumes and lower rates.<br />

Chartering revenue was halved in 2009.<br />

Operating profit before depreciation (EBITDA) was reduced<br />

to DKK 5 million, from DKK 81 million in 2008. This result includes<br />

one-off items amounting to DKK 27 million from the early return of<br />

tonnage and cancellation of charter agreements. After adjustment for<br />

these one-off items, financial performance was down DKK 49 million,<br />

of which DKK 37 million can be attributed to Chartering activities.<br />

The remaining decrease was due to lower performance by Shipping<br />

Logistics, which was partially offset by improved performance by<br />

Intermodal Container Transport. The result also includes costs for staff<br />

reductions and further expansion of IT systems.<br />

The early return of two financially leased sideport ships generated<br />

a profit of DKK 9 million. Depreciation amounted to DKK 50 million,<br />

after which the operating profit (EBIT) was a loss of DKK 35 million.<br />

Average invested capital was DKK 617 million in 2009, down DKK<br />

112 million from 2008 as a result of write-downs made at the end of<br />

2008, the influence of a lower NOK and the return of ships. Return<br />

on invested capital in 2009 was a negative 5.4 %.<br />

BELFAST<br />

DUBLIN<br />

WATERFORD<br />

GREENOCK<br />

LIVERPOOL<br />

IMMINGHAM<br />

AVONMOUTH<br />

CHATHAM<br />

GHENT<br />

ZEEBRUGGE<br />

BREVIK<br />

KRISTIANSAND<br />

ROTTERDAM<br />

MOSS<br />

HALDEN<br />

HAMBURG<br />

BILBAO