English - DFDS

English - DFDS

English - DFDS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>DFDS</strong> annual report 2009 NOTEs 95<br />

>>> Note 28 continued<br />

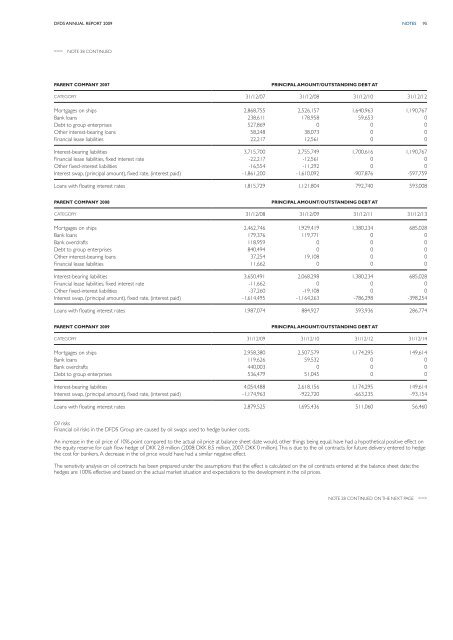

PArent company 2007<br />

Principal amount/outstanding debt at<br />

Category 31/12/07 31/12/08 31/12/10 31/12/12<br />

Mortgages on ships 2,868,755 2,526,157 1,640,963 1,190,767<br />

Bank loans 238,611 178,958 59,653 0<br />

Debt to group enterprises 527,869 0 0 0<br />

Other interest-bearing loans 58,248 38,073 0 0<br />

Financial lease liabilities 22,217 12,561 0 0<br />

Interest-bearing liabilities 3,715,700 2,755,749 1,700,616 1,190,767<br />

Financial lease liabilities, fixed interest rate -22,217 -12,561 0 0<br />

Other fixed-interest liabilities -16,554 -11,292 0 0<br />

Interest swap, (principal amount), fixed rate, (interest paid) -1,861,200 -1,610,092 -907,876 -597,759<br />

Loans with floating interest rates 1,815,729 1,121,804 792,740 593,008<br />

PArent company 2008<br />

Principal amount/outstanding debt at<br />

Category 31/12/08 31/12/09 31/12/11 31/12/13<br />

Mortgages on ships 2,462,746 1,929,419 1,380,234 685,028<br />

Bank loans 179,376 119,771 0 0<br />

Bank overdrafts 118,959 0 0 0<br />

Debt to group enterprises 840,494 0 0 0<br />

Other interest-bearing loans 37,254 19,108 0 0<br />

Financial lease liabilities 11,662 0 0 0<br />

Interest-bearing liabilities 3,650,491 2,068,298 1,380,234 685,028<br />

Financial lease liabilities, fixed interest rate -11,662 0 0 0<br />

Other fixed-interest liabilities -37,260 -19,108 0 0<br />

Interest swap, (principal amount), fixed rate, (interest paid) -1,614,495 -1,164,263 -786,298 -398,254<br />

Loans with floating interest rates 1,987,074 884,927 593,936 286,774<br />

PArent company 2009<br />

Principal amount/outstanding debt at<br />

Category 31/12/09 31/12/10 31/12/12 31/12/14<br />

Mortgages on ships 2,958,380 2,507,579 1,174,295 149,614<br />

Bank loans 119,626 59,532 0 0<br />

Bank overdrafts 440,003 0 0 0<br />

Debt to group enterprises 536,479 51,045 0 0<br />

Interest-bearing liabilities 4,054,488 2,618,156 1,174,295 149,614<br />

Interest swap, (principal amount), fixed rate, (interest paid) -1,174,963 -922,720 -663,235 -93,154<br />

Loans with floating interest rates 2,879,525 1,695,436 511,060 56,460<br />

Oil risks<br />

Financial oil risks in the <strong>DFDS</strong> Group are caused by oil swaps used to hedge bunker costs.<br />

An increase in the oil price of 10%-point compared to the actual oil price at balance sheet date would, other things being equal, have had a hypothetical positive effect on<br />

the equity reserve for cash flow hedge of DKK 2.8 million (2008: DKK 8.5 million, 2007: DKK 0 million). This is due to the oil contracts for future delivery entered to hedge<br />

the cost for bunkers. A decrease in the oil price would have had a similar negative effect.<br />

The sensitivity analysis on oil contracts has been prepared under the assumptions that the effect is calculated on the oil contracts entered at the balance sheet date; the<br />

hedges are 100% effective and based on the actual market situation and expectations to the development in the oil prices.<br />

Note 28 continued on the next page >>>