English - DFDS

English - DFDS

English - DFDS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>DFDS</strong> annual report 2009 Financial review 51<br />

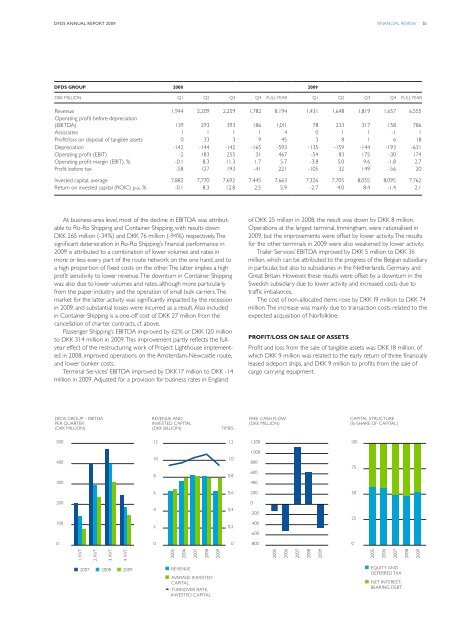

<strong>DFDS</strong> Group 2008 2009<br />

DKK miLLION Q1 Q2 Q3 Q4 Full year Q1 Q2 Q3 Q4 Full year<br />

Revenue 1,944 2,209 2,259 1,782 8,194 1,431 1,648 1,819 1,657 6,555<br />

Operating profit before depreciation<br />

(EBITDA) 139 293 393 186 1,011 78 233 317 158 786<br />

Associates 1 1 1 1 4 0 1 1 -1 1<br />

Profit/loss on disposal of tangible assets 0 33 3 9 45 3 8 1 6 18<br />

Depreciation -142 -144 -142 -165 -593 -135 -159 -144 -193 -631<br />

Operating profit (EBIT) -2 183 255 31 467 -54 83 175 -30 174<br />

Operating profit margin (EBIT), % -0.1 8.3 11.3 1.7 5.7 -3.8 5.0 9.6 -1.8 2.7<br />

Profit before tax -58 127 193 -41 221 -105 32 149 -56 20<br />

Invested capital, average 7,882 7,770 7,692 7,445 7,663 7,326 7,705 8,055 8,095 7,762<br />

Return on invested capital (ROIC) p.a., % -0.1 8.3 12.8 2.5 5.9 -2.7 4.0 8.4 -1.4 2.1<br />

At business-area level, most of the decline in EBITDA was attributable<br />

to Ro-Ro Shipping and Container Shipping, with results down<br />

DKK 265 million (-34 %) and DKK 76 million (-94 %) respectively. The<br />

significant deterioration in Ro-Ro Shipping’s financial performance in<br />

2009 is attributed to a combination of lower volumes and rates in<br />

more or less every part of the route network on the one hand, and to<br />

a high proportion of fixed costs on the other. The latter implies a high<br />

profit sensitivity to lower revenue. The downturn in Container Shipping<br />

was also due to lower volumes and rates, although more particularly<br />

from the paper industry and the operation of small bulk carriers. The<br />

market for the latter activity was significantly impacted by the recession<br />

in 2009, and substantial losses were incurred as a result. Also included<br />

in Container Shipping is a one-off cost of DKK 27 million from the<br />

cancellation of charter contracts, cf. above.<br />

Passenger Shipping’s EBITDA improved by 62 % or DKK 120 million<br />

to DKK 314 million in 2009. This improvement partly reflects the fullyear<br />

effect of the restructuring work of Project Lighthouse implemented<br />

in 2008, improved operations on the Amsterdam-Newcastle route,<br />

and lower bunker costs.<br />

Terminal Services’ EBITDA improved by DKK 17 million to DKK -14<br />

million in 2009. Adjusted for a provision for business rates in England<br />

of DKK 25 million in 2008, the result was down by DKK 8 million.<br />

Operations at the largest terminal, Immingham, were rationalised in<br />

2009, but the improvements were offset by lower activity. The results<br />

for the other terminals in 2009 were also weakened by lower activity.<br />

Trailer Services’ EBITDA improved by DKK 5 million to DKK 36<br />

million, which can be attributed to the progress of the Belgian subsidiary<br />

in particular, but also to subsidiaries in the Netherlands, Germany and<br />

Great Britain. However, these results were offset by a downturn in the<br />

Swedish subsidiary due to lower activity and increased costs due to<br />

traffic imbalances.<br />

The cost of non-allocated items rose by DKK 19 million to DKK 74<br />

million. The increase was mainly due to transaction costs related to the<br />

expected acquisition of Norfolkline.<br />

Profit/loss on sale of assets<br />

Profit and loss from the sale of tangible assets was DKK 18 million, of<br />

which DKK 9 million was related to the early return of three financially<br />

leased sideport ships, and DKK 9 million to profits from the sale of<br />

cargo carrying equipment.<br />

<strong>DFDS</strong> GROUP – EBITDA<br />

PER QUARTER<br />

(DKK MILLION)<br />

REVENUE AND<br />

INVESTED CAPITAL<br />

(DKK BILLION)<br />

TIMES<br />

FREE CASH FLOW<br />

(DKK MILLION)<br />

CAPITAL STRUCTURE<br />

(%-SHARE OF CAPITAL)<br />

500<br />

12<br />

1,2<br />

1.200<br />

100<br />

400<br />

300<br />

10<br />

8<br />

1,0<br />

0,8<br />

1.000<br />

800<br />

600<br />

400<br />

75<br />

6<br />

0,6<br />

200<br />

50<br />

200<br />

100<br />

4<br />

2<br />

0,4<br />

0,2<br />

0<br />

-200<br />

-400<br />

-600<br />

25<br />

0<br />

0<br />

0<br />

-800<br />

0<br />

1. KVT.<br />

2. KVT.<br />

3. KVT.<br />

4. KVT.<br />

2005<br />

2006<br />

2007<br />

2008<br />

2009<br />

2005<br />

2006<br />

2007<br />

2008<br />

2009<br />

2005<br />

2006<br />

2007<br />

2008<br />

2009<br />

2007 2008 2009<br />

REVENUE<br />

AVERAGE INVESTED<br />

CAPITAL<br />

TURNOVER RATE,<br />

INVESTED CAPITAL<br />

EQUITY AND<br />

DEFERRED TAX<br />

NET INTEREST-<br />

BEARING DEBT