English - DFDS

English - DFDS

English - DFDS

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>DFDS</strong> annual report 2009 NOTEs 91<br />

Parent Company<br />

DKK ‘000<br />

Consolidated<br />

DKK ‘000<br />

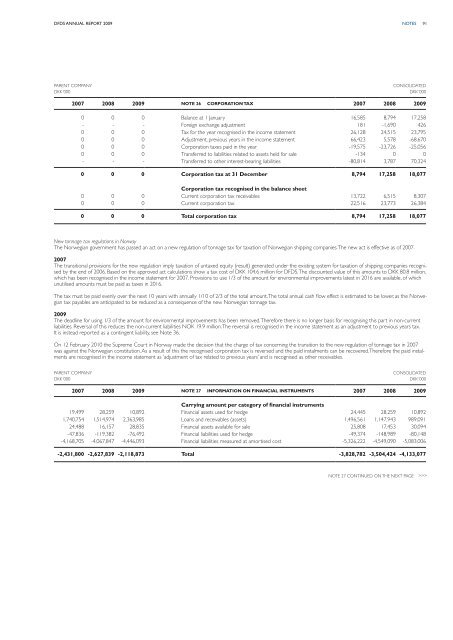

2007 2008 2009 Note 26 Corporation tax 2007 2008 2009<br />

0 0 0 Balance at 1 January 16,585 8,794 17,258<br />

- - - Foreign exchange adjustment 181 -1,690 426<br />

0 0 0 Tax for the year recognised in the income statement 26,128 24,515 23,795<br />

0 0 0 Adjustment, previous years in the income statement 66,423 5,578 -68,670<br />

0 0 0 Corporation taxes paid in the year -19,575 -23,726 -25,056<br />

0 0 0 Transferred to liabilities related to assets held for sale -134 0 0<br />

- - - Transferred to other interest-bearing liabilities -80,814 3,787 70,324<br />

0 0 0 Corporation tax at 31 December 8,794 17,258 18,077<br />

Corporation tax recognised in the balance sheet<br />

0 0 0 Current corporation tax receivables 13,722 6,515 8,307<br />

0 0 0 Current corporation tax 22,516 23,773 26,384<br />

0 0 0 Total corporation tax 8,794 17,258 18,077<br />

New tonnage tax regulations in Norway<br />

The Norwegian government has passed an act on a new regulation of tonnage tax for taxation of Norwegian shipping companies. The new act is effective as of 2007.<br />

2007<br />

The transitional provisions for the new regulation imply taxation of untaxed equity (result) generated under the existing system for taxation of shipping companies recognised<br />

by the end of 2006. Based on the approved act calculations show a tax cost of DKK 104.6 million for <strong>DFDS</strong>. The discounted value of this amounts to DKK 80.8 million,<br />

which has been recognised in the income statement for 2007. Provisions to use 1/3 of the amount for environmental improvements latest in 2016 are available, of which<br />

unutilised amounts must be paid as taxes in 2016.<br />

The tax must be paid evenly over the next 10 years with annually 1/10 of 2/3 of the total amount. The total annual cash flow effect is estimated to be lower, as the Norwegian<br />

tax payables are anticipated to be reduced as a consequence of the new Norwegian tonnage tax.<br />

2009<br />

The deadline for using 1/3 of the amount for environmental improvements has been removed. Therefore there is no longer basis for recognising this part in non-current<br />

liabilities. Reversal of this reduces the non-current liabilities NOK 19.9 million. The reversal is recognised in the income statement as an adjustment to previous years tax.<br />

It is instead reported as a contingent liability, see Note 36.<br />

On 12 February 2010 the Supreme Court in Norway made the decision that the charge of tax concerning the transition to the new regulation of tonnage tax in 2007<br />

was against the Norwegian constitution. As a result of this the recognised corporation tax is reversed and the paid instalments can be recovered. Therefore the paid instalments<br />

are recognised in the income statement as ’adjustment of tax related to previous years’ and is recognised as other receivables.<br />

Parent Company<br />

DKK ‘000<br />

Consolidated<br />

DKK ‘000<br />

2007 2008 2009 Note 27 Information on financial instruments 2007 2008 2009<br />

Carrying amount per category of financial instruments<br />

19,499 28,259 10,892 Financial assets used for hedge 24,445 28,259 10,892<br />

1,740,754 1,514,974 2,363,985 Loans and receivables (assets) 1,496,561 1,147,943 989,091<br />

24,488 16,157 28,835 Financial assets available for sale 25,808 17,453 30,094<br />

-47,836 -119,382 -76,492 Financial liabilities used for hedge -49,374 -148,989 -80,148<br />

-4,168,705 -4,067,847 -4,446,093 Financial liabilities measured at amortised cost -5,326,222 -4,549,090 -5,083,006<br />

-2,431,800 -2,627,839 -2,118,873 Total -3,828,782 -3,504,424 -4,133,077<br />

Note 27 continued on the next page >>>