English - DFDS

English - DFDS

English - DFDS

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>DFDS</strong> annual report 2009 NOTEs 87<br />

>>> Note 20 continued<br />

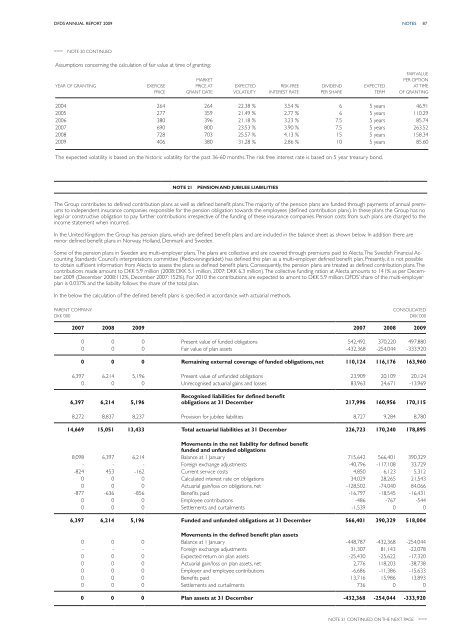

Assumptions concerning the calculation of fair value at time of granting:<br />

Year of grantinG<br />

EXERCISE<br />

PRICE<br />

MARKET<br />

PRICE AT<br />

GRANT DATE<br />

EXPECTED<br />

VOLATILITY<br />

RISK-FREE<br />

INTEREST RATE<br />

DIVIDEND<br />

PER SHARE<br />

EXPECTED<br />

TERM<br />

FAIR VALUE<br />

PER OPTION<br />

AT TIME<br />

OF GRANTING<br />

2004 264 264 22.38 % 3.54 % 6 5 years 46.91<br />

2005 277 359 21.49 % 2.77 % 6 5 years 110.29<br />

2006 380 396 21.18 % 3.23 % 7.5 5 years 85.74<br />

2007 690 800 23.53 % 3.90 % 7.5 5 years 263.52<br />

2008 728 703 25.57 % 4.13 % 15 5 years 158.34<br />

2009 406 380 31.28 % 2.86 % 10 5 years 85.60<br />

The expected volatility is based on the historic volatility for the past 36-60 months. The risk free interest rate is based on 5 year treasury bond.<br />

Note 21<br />

Pension and jubilee liabilities<br />

The Group contributes to defined contribution plans as well as defined benefit plans. The majority of the pension plans are funded through payments of annual premiums<br />

to independent insurance companies responsible for the pension obligation towards the employees (defined contribution plans). In these plans the Group has no<br />

legal or constructive obligation to pay further contributions irrespective of the funding of these insurance companies. Pension costs from such plans are charged to the<br />

income statement when incurred.<br />

In the United Kingdom the Group has pension plans, which are defined benefit plans and are included in the balance sheet as shown below. In addition there are<br />

minor defined benefit plans in Norway, Holland, Denmark and Sweden.<br />

Some of the pension plans in Sweden are multi-employer plans. The plans are collective and are covered through premiums paid to Alecta. The Swedish Financial Accounting<br />

Standards Council’s interpretations committee (Redovisningsrådet) has defined this plan as a multi-employer defined benefit plan. Presently, it is not possible<br />

to obtain sufficient information from Alecta to assess the plans as defined benefit plans. Consequently, the pension plans are treated as defined contribution plans. The<br />

contributions made amount to DKK 5.9 million (2008: DKK 5.1 million, 2007: DKK 6.3 million). The collective funding ration at Alecta amounts to 141% as per December<br />

2009 (December 2008:112%, December 2007: 152%). For 2010 the contributions are expected to amont to DKK 5.9 million. <strong>DFDS</strong>’ share of the multi-employer<br />

plan is 0.037% and the liability follows the share of the total plan.<br />

In the below the calculation of the defined benefit plans is specified in accordance with actuarial methods.<br />

Parent Company<br />

DKK ‘000<br />

Consolidated<br />

DKK ‘000<br />

2007 2008 2009 2007 2008 2009<br />

0 0 0 Present value of funded obligations 542,492 370,220 497,880<br />

0 0 0 Fair value of plan assets -432,368 -254,044 -333,920<br />

0 0 0 Remaining external coverage of funded obligations, net 110,124 116,176 163,960<br />

6,397 6,214 5,196 Present value of unfunded obligations 23,909 20,109 20,124<br />

0 0 0 Unrecognised actuarial gains and losses 83,963 24,671 -13,969<br />

6,397 6,214 5,196<br />

Recognised liabilities for defined benefit<br />

obligations at 31 December 217,996 160,956 170,115<br />

8,272 8,837 8,237 Provision for jubilee liabilities 8,727 9,284 8,780<br />

14,669 15,051 13,433 Total actuarial liabilities at 31 December 226,723 170,240 178,895<br />

Movements in the net liability for defined benefit<br />

funded and unfunded obligations<br />

8,098 6,397 6,214 Balance at 1 January 715,642 566,401 390,329<br />

- - - Foreign exchange adjustments -40,796 -117,108 33,729<br />

-824 453 -162 Current service costs 4,850 6,123 5,312<br />

0 0 0 Calculated interest rate on obligations 34,029 28,265 21,543<br />

0 0 0 Actuarial gain/loss on obligations, net -128,502 -74,040 84,066<br />

-877 -636 -856 Benefits paid -16,797 -18,545 -16,431<br />

0 0 0 Employee contributions -486 -767 -544<br />

0 0 0 Settlements and curtailments -1,539 0 0<br />

6,397 6,214 5,196 Funded and unfunded obligations at 31 December 566,401 390,329 518,004<br />

Movements in the defined benefit plan assets<br />

0 0 0 Balance at 1 January -448,787 -432,368 -254,044<br />

- - - Foreign exchange adjustments 31,307 81,143 -22,078<br />

0 0 0 Expected return on plan assets -25,430 -25,622 -17,320<br />

0 0 0 Actuarial gain/loss on plan assets, net 2,776 118,203 -38,738<br />

0 0 0 Employer and employee contributions -6,686 -11,386 -15,633<br />

0 0 0 Benefits paid 13,716 15,986 13,893<br />

0 0 0 Settlements and curtailments 736 0 0<br />

0 0 0 Plan assets at 31 December -432,368 -254,044 -333,920<br />

Note 21 continued on the next page >>>